The BOE has held off raising rates for a long time now. The last MPC meeting made it evident that a strong GBP was a larger concern for the BoE than previously perceived. After the ECB disappointed the market significantly last week, the downward pressure on EUR/GBP has eased from the EUR leg, which should calm the MPC members as the degree of monetary policy divergence has declined.

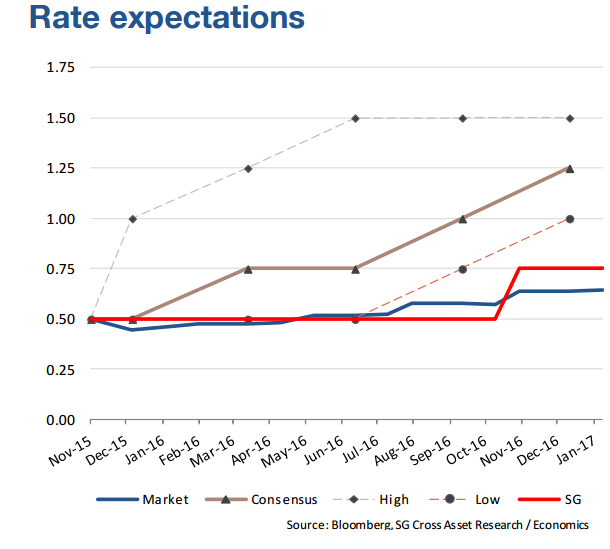

"All things being equal, this is supportive for our hawkish BoE view. We expect the Bank Rate and the stock of purchased assets to stay unchanged at 0.50% and GBP375bn, respectively. With respect to the rate decision,we think the vote will be unchanged at 8-1." said Danske Bank in a note to its clients.

Governor Mark Carney, speaking after the most recent Inflation Report, noted rising levels of consumer credit, house price growth and a falling savings rate, saying those factors "bring into scope some macroprudential considerations." The BoE has been given some macro-prudential powers include making banks fill the countercyclical buffer, as well as limiting lending judged to be inflating asset bubbles in order to prevent a banking system from posing risks to its solvency.

The Bank of England stress test results released last week indicated British banks' long capital build is nearly complete. The UK supervisor said on Dec. 1 that none of the country's big seven lenders had failed its 2015 stress tests, although Royal Bank of Scotland and Standard Chartered initially flunked on some supplemental metrics. This raises chances that the BoE could likely wield its "macroprudential mop" and force lenders to begin to build up capital that can be used to support lending in an economic downturn and market will probably view the move as tightening of policy.

"Just because any change in macroprudential policy is likely to be sold in reference to the prevailing risks rather than relative to monetary policy does not mean the market will not treat the change as a partial substitute for rate hikes. If the tightening binds economic activity then it would lessen the need to hike rates in either case." noted economists at Nomura International Plc.

GBP/USD is back inside hourly cloud, probing through 200/100 HMAs at 1.5066/1.5057. Further weakness is likely but need to sustain break of Friday's 1.5079 base. Cable is currently trading at 1.5088 as of 1115 GMT and EUR/GBP was at 0.7176

BoE to stay pat at Thursday's meet, scope for some macroprudential considerations

Monday, December 7, 2015 11:39 AM UTC

Editor's Picks

- Market Data

Most Popular

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty