The Bank of England kept its interest rates steady on Thursday as expected and showed no sign it was close to raising interest rates. Votes were split 8-1 once again to hold rates at a record lows, but the MPC voted unanimously in favour of keeping the stock of purchased assets unchanged at GBP375bn.

The minutes were slightly dovish as the BoE has lowered its inflation outlook and now expects CPI inflation to stay below 1% until spring next year. The c.bank acknowledged that the outlook for inflation in coming months looked weaker than it previously thought. Minutes support the view that the BoE's focus has shifted to inflation and that the BoE will not hike rates until CPI inflation has moved higher.

UK CPI inflation is likely to remain close to 0% in coming months and one cannot rule out that inflation may turn negative. Most MPC members are not comfortable raising rates with higher uncertainty in the near-term. Also interest rate on derivatives that hug the BOE's benchmark suggest BoE won't begin tightening policy until the end of 2016, or even early 2017.

"We still expect BoE to hike in Q1 16, probably in February. CPI inflation is expected to pick up in January when the base effects from the oil price drop in H2 14 disappears. Also we are still positive on the UK and the economic upturn remains on track, in our view, with growth rates above or at trend (0.5% q/q)", says Danske Bank in a research note.

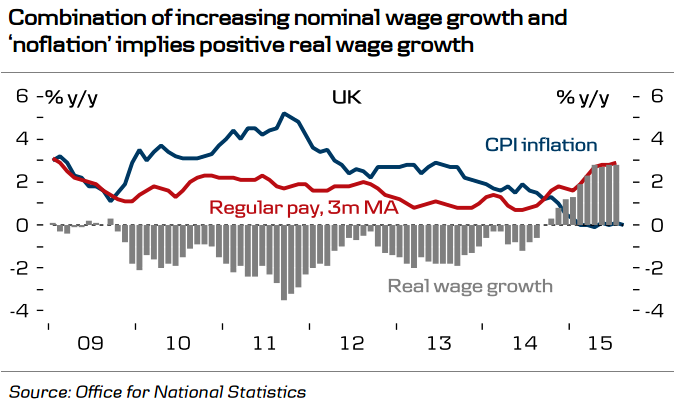

UK unemployment rate is already more or less back to 'normal' and the labour market is likely to tighten further going forward which would lead to even higher wage growth. The minutes acknowledge that the labour market is tightening, saying that 'labour skill shortages had become increasingly widespread'. It also said data which showed a rise in labour costs probably overstated the strength of wage pressures. Parts of the labour market were hit by skills shortages but productivity was rising, neutralising some of the impact of higher wages.

The MPC members are so far not that worried about the economic slowdown in China and emerging markets and the impact on the UK but are monitoring the development. Policymakers acknowledged the slowdown in emerging markets but disagreed about whether it was worse than they expected earlier this year with China showing steady levels of activity.

"In the short term we expect weak inflation to support EUR/GBP and thus see little prospect of a change in trend for both EUR/GBP and GBP/USD. Over the medium term, we still look for a stronger GBP supported by higher UK interest rates following a BoE rate hike. We target EUR/GBP at 0.70 and GBP/USD at 1.57 in 6M", notes Danske Bank.

EUR/GBP is trading at 0.7379 at 1016 GMT. Intraday rise stemmed by 200 HMA/10 DMA at 0.7384/85. Sterling lost grip vs. the dollar after UK Aug trade deficit came in at £11.15 bln during, missing expectations at £10.0 bln. GBP/USD slipped to session lows in the 1.5350/45 band after trading at 1.5383 highs.

BoE rate hike likely in Feb 2016, subsequent higher rates to make GBP stronger

Friday, October 9, 2015 11:02 AM UTC

Editor's Picks

- Market Data

Most Popular

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons