SEOUL – TokenPost, South Korea's largest blockchain media outlet, announced on the 8th the launch of 'TokenPost Index (TPI)', a suite of indices designed to offer a comprehensive view of the cryptocurrency market dynamics.

Developed in collaboration with cryptocurrency indexing specialist Global Market Crypto Intelligence (GMCI) and cryptocurrency spot and futures exchange WOO X, these indices aim to simplify access to swift digital asset and blockchain news, aiding market understanding and investment decisions.

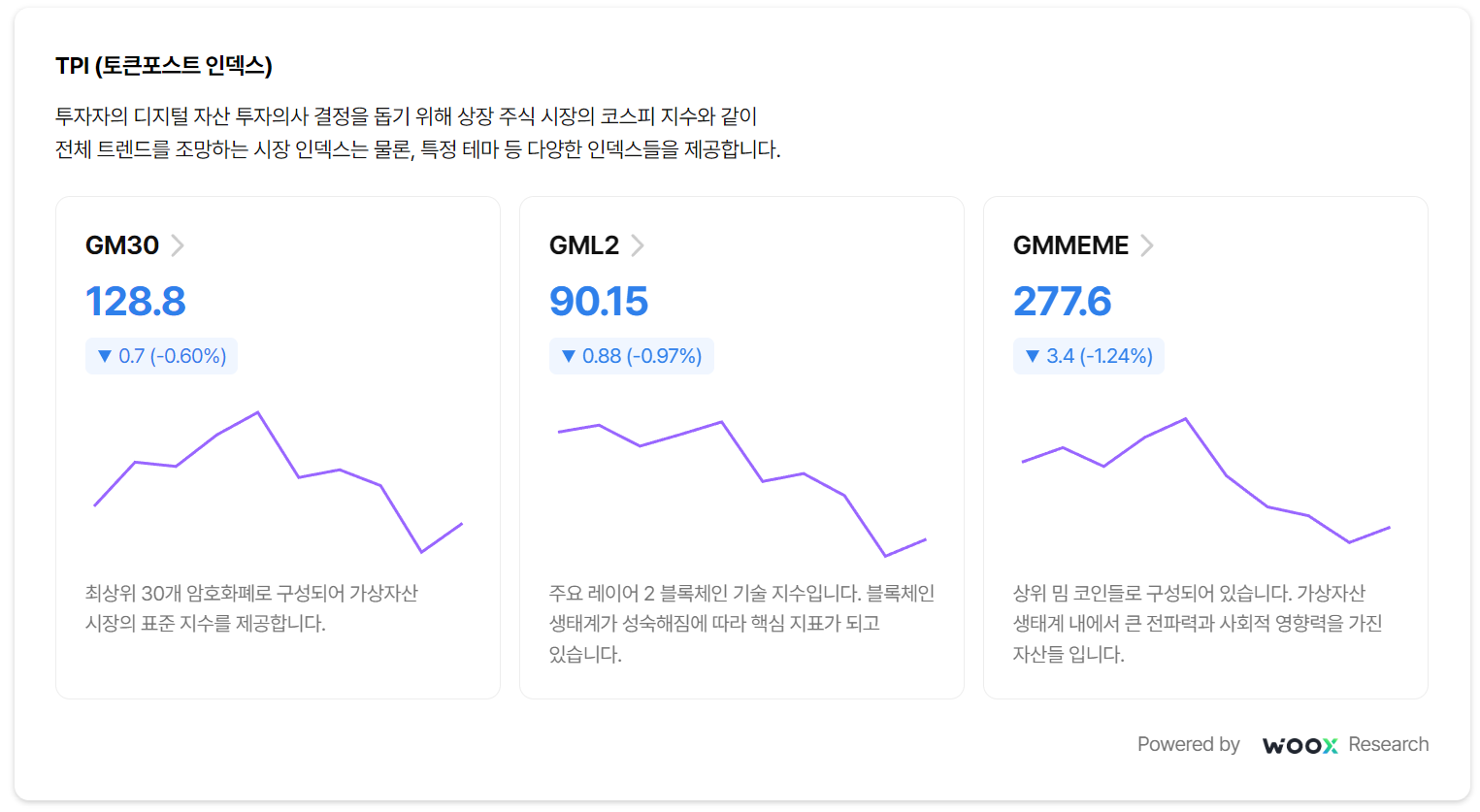

The three introduced indices include the top 30 virtual assets index 'GM30', the Layer 2 solutions index 'GML2', and the top meme coin index 'GMMEME'.

GM30 is a benchmark index composed of the top 30 cryptocurrencies including Ethereum (ETH), Bitcoin (BTC), and Binance Coin (BNB), which are key to market momentum. This index facilitates a broader understanding of the virtual asset market by including assets notable for their resilience, innovation, and impact. It spans various sectors from smart contract platforms to DeFi tokens, serving as a barometer for ecosystem growth, reflecting technological advancement, trends, and investment sentiment.

GML2 tracks innovative 'Layer 2' technologies designed to enhance blockchain scalability and efficiency. It comprises eight key Layer 2 solutions such as Polygon (MATIC), Stacks (STX), Arbitrum (ARB), and others, reflecting the potential and growth of Layer 2 technologies and their impact on blockchain scalability.

GMMEME follows the market cap of the leading meme coins, including Shiba Inu (SHIB) and Dogecoin (DOGE). This index focuses on assets with significant community engagement and market presence, reflecting the characteristics of the virtual asset and Web3 communities that value fun and narrative.

TokenPost's 3 indices are designed to dissect the complex and voluminous data of the rapidly evolving market into sophisticated, comprehensible indices, providing clear perspectives and understanding of the market.

"These indices will allow market participants to easily navigate the market, evaluate investment strategies, and make decisions, enhancing market transparency and thus trust and accessibility," said David Kim, CEO of TokenPost. "We plan to further enrich our offerings with additional indices targeting various market aspects such as Bitcoin hedging and asset sentiment," he added, emphasizing ongoing efforts to provide investors with valuable information through new indices.

TokenPost anticipates that these reliable indices will contribute to market maturity and sophistication, aiming to continuously expand the scope of market viewpoints available to investors.

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock