Bank Negara Malaysia (BNM) is expected to maintain its current accommodative stance and keep the Overnight Policy Rate (OPR) unchanged at 3.25 percent for some time, owing to expectations of a muted inflation in the country till mid-2019, according to the latest report from ANZ Research.

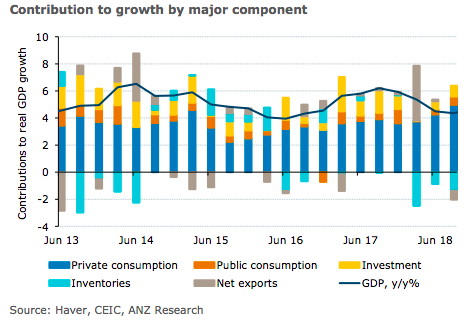

Malaysia’s GDP growth edged down to 4.4 percent y/y in the Q3 from 4.5 percent y/y in Q2. On the expenditure side, private consumption which rose 9.0 percent y/y was the primary contributor to growth, boosted by the 'tax holiday' in July and August.

A rise in 'machinery and equipment investment' buoyed overall investment growth. On a sectoral basis, lingering supply issues in the agriculture and mining sectors dragged down overall growth.

"Given the weaker than expected Q3 GDP print, our 5.1 percent growth forecast for 2018 is not likely to be achieved, and we are putting the forecast under review for a downgrade," the report commented.

Further, on a On a sequential basis, GDP grew at 1.6 percent q/q. In part, this is due to a positive base effect after a weaker-than-expected 0.3 percent q/q outturn in Q2. While the drag on quarterly growth from net exports reduced in Q3, a drawdown in inventories shaved 0.6ppt off growth in Q3.

Meanwhile, the fiscal space in Malaysia remains challenging, and the path of fiscal consolidation has been delayed. Along with the recent fall in oil prices, this presents a risk to the MYR. Additionally, further US-China trade tensions remain a key risk for Malaysian trade as it is well integrated into regional supply chains, the report further noted.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty