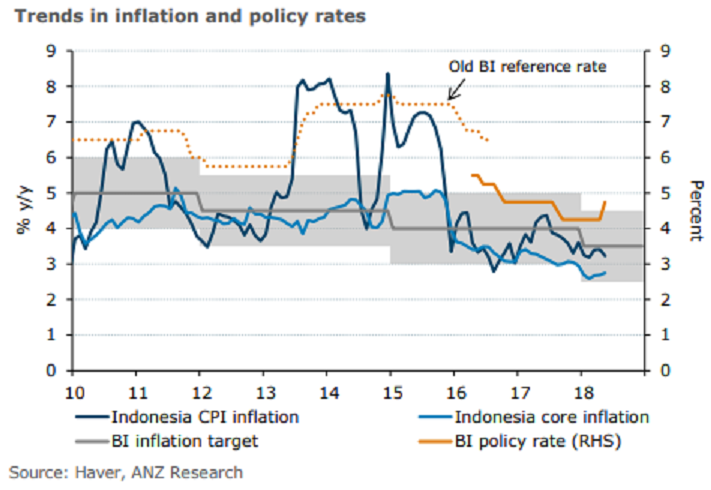

Bank Indonesia (BI) is expected to call for a final rate hike of 25 basis points in its June monetary policy meeting, according to the latest report from ANZ Research. Headline inflation has remained below the mid-point of the central bank’s target band in each month this year, confirming that the objective of the recent policy tightening is to stabilize the IDR and not inflation management.

Owing to the commencement of the Ramadan fasting season from mid-May, headline inflation quite predictably picked up during the month. The increase itself was more contained m/m than was expected owing to moderate increases in food prices (0.21 percent m/m) and energy costs (0.04 percent m/m).

The rise in energy prices compares with an average of 0.29 percent m/m in the previous four months of 2018. Similarly, utility costs, which include electricity costs, also increased by their slowest pace during the year.

Price changes in other sub-components were in line with recent trends. Core inflation increased by 0.21 percent m/m which though faster than the 0.15 percent m/m rise in April, was still mild. Headline inflation has now remained below the mid-point of Bank Indonesia’s (BI) target corridor of 2.5-4.5 percent in each month this year, confirming that the objective of the recent policy tightening is to stabilize the IDR and not inflation management.

"To further this objective we still expect one more rate hike of 25bps in June 2018, following which BI should be able to comfortably revert back to a neutral policy stance," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed