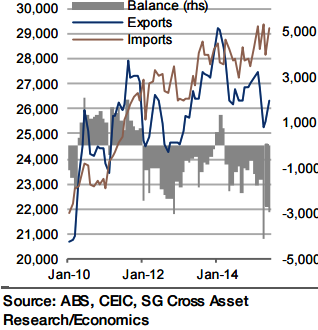

According to the official advanced estimate, imports were practically unchanged in July from June (0.2% mom), meaning that they remained at a high level, and were up by around 4.5% yoy. That said, all of this gain, and more, can be explained by the exchange rate, which in trade-weighted terms was down 13.5% yoy in July.

The volume of imports was estimated about flat over the past year, with the difference explained by weakness in commodity prices, specifically oil, of which Australia is a net importer. Exports, meanwhile, are expected to have continued their recovery after the 8.1% decline they suffered in March/April, but faced a serious headwind in July as the price of iron ore plummeted 17% from June (Port of Qingdao).

"Still, China's July figures for imports from Australia jumped to -4.5% yoy from - 26.5% in June, a move that can only partly be explained by a base effect. Overall, a muted 0.5% increase is expected in exports. As a consequence, the trade deficit should only improve fractionally", says Societe Generale.

Australia's robust imports and weak export prices keep trade deficit elevated

Monday, August 31, 2015 6:09 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal