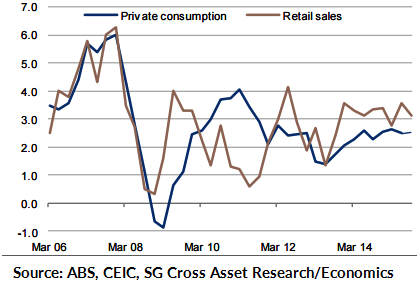

Australia's Q3 retail sales data came in below expectations, with a gain of 0.6% qoq. However it was consistent with a moderate expansion. This reflects increase in deflator of 0.3%. There was 0.7% qoq expansion in Q2 2015.

The real sales were ahead of 10-year average growth rate, which implies that there is a considerable private comsumption expansion. But, the retail sales are not even reaching one-third of the private consumption, so keeping retail sales in veiw, conclusions cannot be drawn regarding total private expenditure.

Also, tourism industry supports the retail sales to a large extent, particularly the food and beverage industry. Hence other indicators should be checked well which show support, for example total vehicle registration was up 1.9% qoq, passenger vehicles slaes climbed 3.5% qoq, highest in last 4 years.

Average consumer sentiment index was little weaker in Q3 on Westpac's monthly index, nonethelss it recorded stability in ANZ's Roy Morgan weekly index.

"In any case, given the very loose relationship between consumer sentiment and retail sales, much faith cannot be put on in the sentiment data as a guide to private consumption trends. Based on these indicators, private consumption is expected to have expanded a bit more than in Q2, 2.2% at an annualized rate after 1.9% in Q2", says Societe Generale.

Australia's private consumption likely expanded in Q2

Thursday, November 5, 2015 4:33 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX