Australia’s housing finance commitments were down again in April, in line with market expectations. The value of Australian housing finance commitments fell again in April, albeit not as sharply as the previous month. The weakness was again driven by the investor segment, while owner-occupier borrowing was flat.

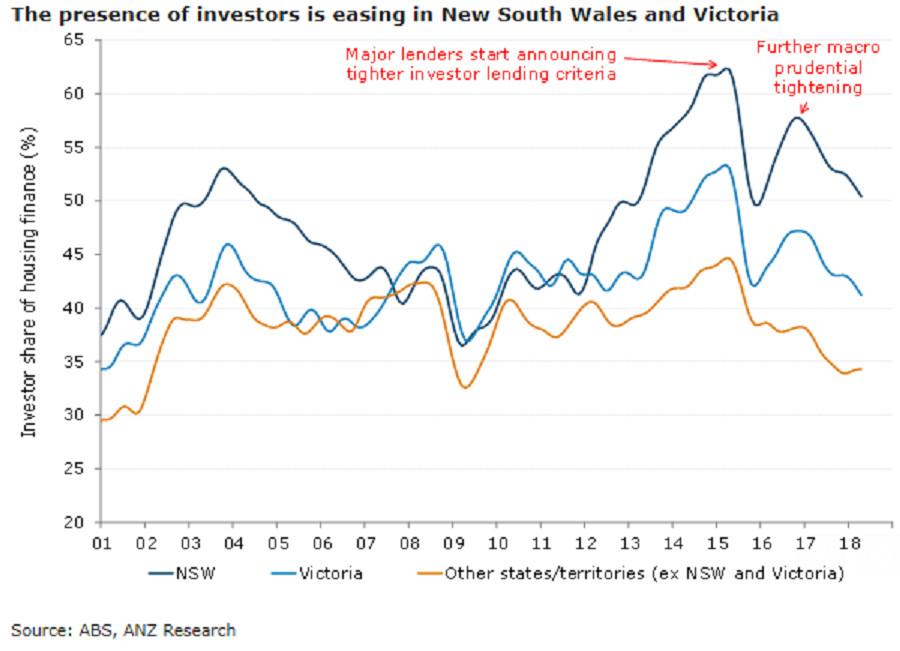

The share of borrowing by investors continues to fall, and at 42 percent is the lowest since 2012. New South Wales and Victoria have seen the sharpest declines, consistent with the rapid cooling in their respective housing markets in recent months.

Investors did return to the new property market, with finance for the construction of new dwellings mostly offsetting last month’s fall. However, further weakness in the new property segment from owner occupiers means that overall finance for the construction and purchase of new dwellings continues to trend lower. This suggests that building approvals will follow suit in the coming months.

Finance approvals for first home buyers in these two states are down 8 percent from the November 2017 peak. While falling house prices are broadly positive for these buyers, further credit tightening is likely to weigh on the segment.

"Looking forward, tighter credit conditions are likely to continue to bite, suggesting that housing finance will remain soft for some time yet," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal