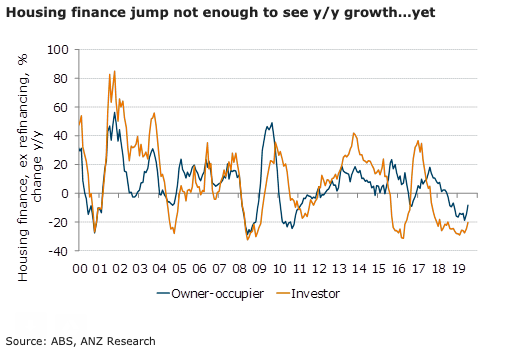

Australia’s demand for mortgages picked up sharply in response to rate cuts in June and July, with 5.1 percent m/m growth in July. The strength was reflected across both owner-occupiers and investors. The Reserve Bank of Australia (RBA) is unlikely to be impressed by these numbers, according to the latest report from ANZ Research.

Investor lending was up 4.7 percent m/m in July, ex-refinancing, the strongest monthly result since September 2016. This is a strong sign of investor optimism after sharp declines in investor demand during the housing price adjustment. Annual growth in investor lending is still sharply negative (-20.4 percent y/y to July), however this is the smallest negative result since July 2018.

Owner-occupier lending grew 5.3 percent m/m in July ex refinancing, the highest result since August 2015. Annual growth is still negative (-8.3 percent y/y), but it is the smallest negative result since October 2018.

Interestingly, approvals for the purchase of new homes jumped 20.8 percent, the strongest rise since 2001. This suggests that the pick-up in housing prices and finance will soon feed through into construction activity.

Regulatory easing in July (APRA relaxed the 7 percent+ floors on mortgage serviceability) heightened the effects of rate cuts, by allowing lower rates to more directly affect serviceability assessments.

Optimism in the housing market following green shoots in prices in Sydney and Melbourne prices may have also spurred on extra demand. Ongoing elevated auction clearance rates suggest that the strength has continued into September.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist