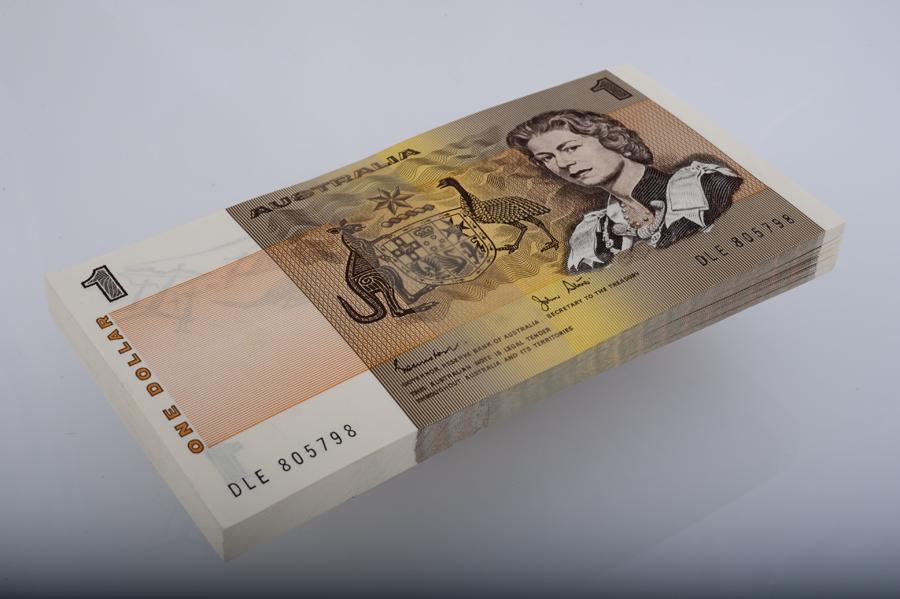

Record-Breaking Debt Sales in Australia

Australian dollar debt sales are experiencing unprecedented growth, with A$267.6 billion (approximately $180.4 billion) raised as of October 8, the highest figure recorded since 1995. This surge is primarily driven by the refinancing of pandemic-era borrowings amid strong investor demand.

Key Market Insights

Financial institutions have contributed A$95.6 billion in debt, marking a record year-to-date issuance. Additionally, A$61.4 billion has been raised in asset and mortgage-backed securities, while corporate issuance has surged nearly 70% year-on-year, totaling A$26.4 billion.

However, market experts note a recent slowdown in activity. Simon Ward, head of debt capital markets for Australasia at Mizuho Securities Asia, highlights the potential for increased volatility as the U.S. election approaches, which could impact investor sentiment and market conditions.

Demand Dynamics

According to LSEG data, Australian bond funds attracted $4.8 billion in the first three quarters of 2024, the largest influx in 14 years. Performance metrics are also promising; the ICE BofA index of AAA Australian corporate debt has risen 3.8%, outperforming the 2.2% increase of the U.S. AAA corporate index.

Market Outlook

Despite the slowdown, the Australian dollar debt market remains a critical segment of the global $7.2 trillion debt capital market. While domestic banks dominate, international players are increasingly participating, indicating a seller's market driven by strong demand from yield-seeking Asian investors.

As the year progresses, market stakeholders must stay vigilant, adapting to evolving conditions as the U.S. election introduces uncertainty into the global financial landscape.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns