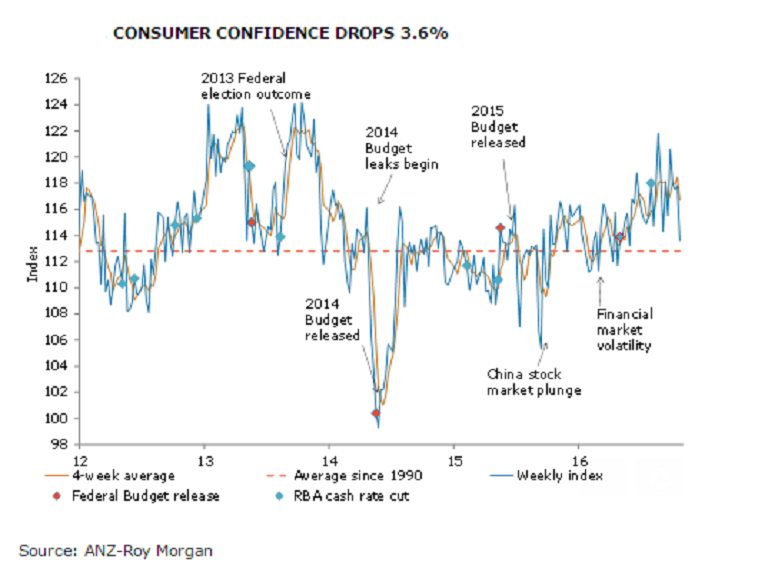

Consumer confidence in Australia fell sharply during the week ended October 23, largely driven by deterioration in consumers’ outlook of the future financial and economic conditions of the country.

The ANZ-Roy Morgan Australian consumer confidence plunged 3.6 percent, helped by views towards finances over the next 12 months which dropped 7.1 percent, bringing the index down to its lowest level since September last year.

Consumers’ views toward the economy, both current and future, also fell. Households’ view of current economic conditions index fell 2.7 percent, while views towards economic conditions over the next 5 years fell a steeper 4.9 percent. However, consumers’ views towards their current finances remained relatively stable, edging down just 0.2 percent.

In addition, household views on whether 'now is a good time to buy a household item' fell 2.4 percent, unwinding last week’s 2.0 percent gain. Inflation expectations remained stable at 4.2 percent.

"We expect that last week’s labor market report showing ongoing weakness in full-time employment likely weighed on sentiment, while stock market falls over the past couple of weeks could also have dampened consumers’ view of the outlook," said Felicity Emmett, Head, Australian Economics, ANZ.

Meanwhile, heading into the Q3 inflation report this week, inflation expectations have been trending a bit higher. But the data is expected to show still weak inflationary pressures, and inflation outcomes are likely to remain an important driver of inflation expectations, ANZ reported.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure