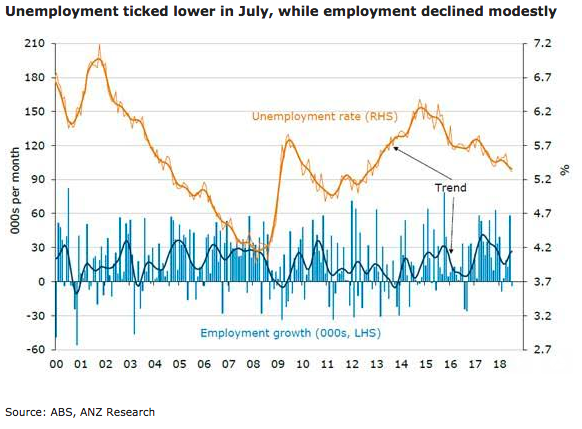

Australia’s unemployment rate, edged down again and at 5.3 percent is at a six-year low, alongside a decline in the participation rate from 65.7 percent to 65.5 percent. Leading indicators for the labour market are slightly more mixed than they have been, but continue to point to ongoing improvement in the near term, according to the latest report from ANZ Research.

Employment fell 3.9k in July, following an upwardly revised 58.2k jump in June. The weakness was driven by part-time jobs which fell 23.2k, while full-time jobs were up 19.3K after the 43.2k rise in June.

Across the country, in a reversal of last month’s trends, NSW was the weakest with employment down sharply (-27.1), while Victoria was the strongest (+29.4K). Elsewhere, there were small falls in WA (-3.0K) and Qld (-1.9K), while the other states and territories saw modest rises.

"Overall though they continue to point to ongoing gradual improvement in the labour market in the near term, with a further decline in the unemployment rate. Ongoing improvement in the labour market is critical to the outlook for wages growth and the eventual return of inflation to the mid-point of the RBA’s 2–3 percent target band," the report added.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility