Arctos Partners has chosen to invest in Aston Martin’s Formula One team ahead of F1’s anticipated return to Las Vegas. This deal places a valuation of approximately £1 billion on the racing unit.

It also marked the first instance where team owner Lawrence Stroll has sought external investors for the F1 team he is associated with, according to the Financial Times.

Arctos Joins Holding Company of Aston Martin's F1 Team: AMR Holdings GP Limited

Reuters reported that this significant investment by Arctos entails the acquisition of a "minority shareholding" in AMR Holdings GP Limited, the holding company of Aston Martin's F1 team. While specific financial details were not disclosed, confidential sources suggest a £1 billion valuation for the team.

Arctos stands alongside Saudi Aramco as a partner of the team, while not holding a stake in the business. However, the state oil group assumes the option to purchase 10% of the unit in the future. Lawrence Stroll expressed his satisfaction with Arctos' involvement, highlighting their valuable industry insights. The Aston Martin team is now proud to join Arctos' esteemed portfolio of investments.

Arctos boasts an extensive sports portfolio, including ownership stakes in various sports such as football, basketball, and baseball. Notably, they hold a minority stake in Fenway Sports Group, the parent company of Liverpool Football Club and the Red Sox baseball team, solidifying their presence in the sports industry.

Arctos plans to provide substantial resources to enhance the team's brand and extend its reach, drawing from their extensive experience in sports management.

F1 Team Valuations Continue to Rise

The valuation of F1 teams has seen significant growth since Lawrence Stroll's acquisition of the team, originally known as Force India, before rebranding as Racing Point and ultimately becoming Aston Martin in 2021. In June, Renault's Alpine outfit achieved a valuation of approximately $900mn, following investments from RedBird Capital Partners, Otro Capital, and Hollywood actor Ryan Reynolds, resulting in a 24% stake.

Sir Jim Ratcliffe’s Ineos acquired a one-third stake in the Mercedes F1 team, totaling £208 million in January 2022. Dorilton, a US-based investment group, completed the acquisition of the Williams team for €152mn in August 2020. Additionally, McLaren sold a stake worth £560 million to MSP Sports Capital and other investors in December of the same year.

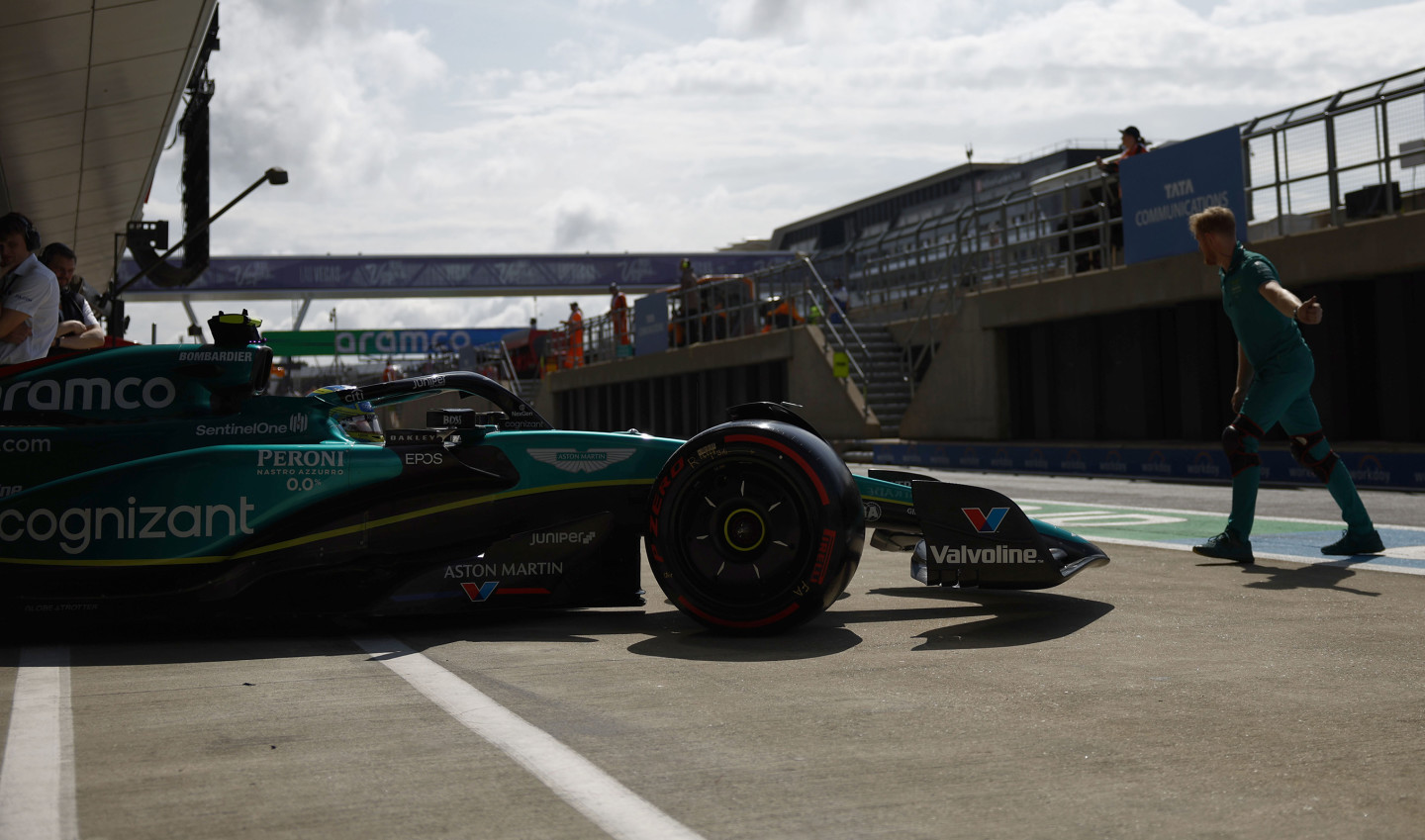

Photo: Aston Martin F1 Newsroom

Why Manchester City offered Erling Haaland the longest contract in Premier League history

Why Manchester City offered Erling Haaland the longest contract in Premier League history  Trump to Host UFC Event at White House on His 80th Birthday

Trump to Host UFC Event at White House on His 80th Birthday  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  LA28 Confirms Olympic Athletes Exempt from Trump’s Travel Ban

LA28 Confirms Olympic Athletes Exempt from Trump’s Travel Ban  SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom

SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists

South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists  Trump Signs Executive Order Targeting Big-Money College Athlete Payouts

Trump Signs Executive Order Targeting Big-Money College Athlete Payouts  Why your retirement fund might soon include cryptocurrency

Why your retirement fund might soon include cryptocurrency  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Trump’s U.S. Open Visit Delays Final, Fans Face Long Security Lines

Trump’s U.S. Open Visit Delays Final, Fans Face Long Security Lines  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’

Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  NBA Returns to China with Alibaba Partnership and Historic Macau Games

NBA Returns to China with Alibaba Partnership and Historic Macau Games  Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure

Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure