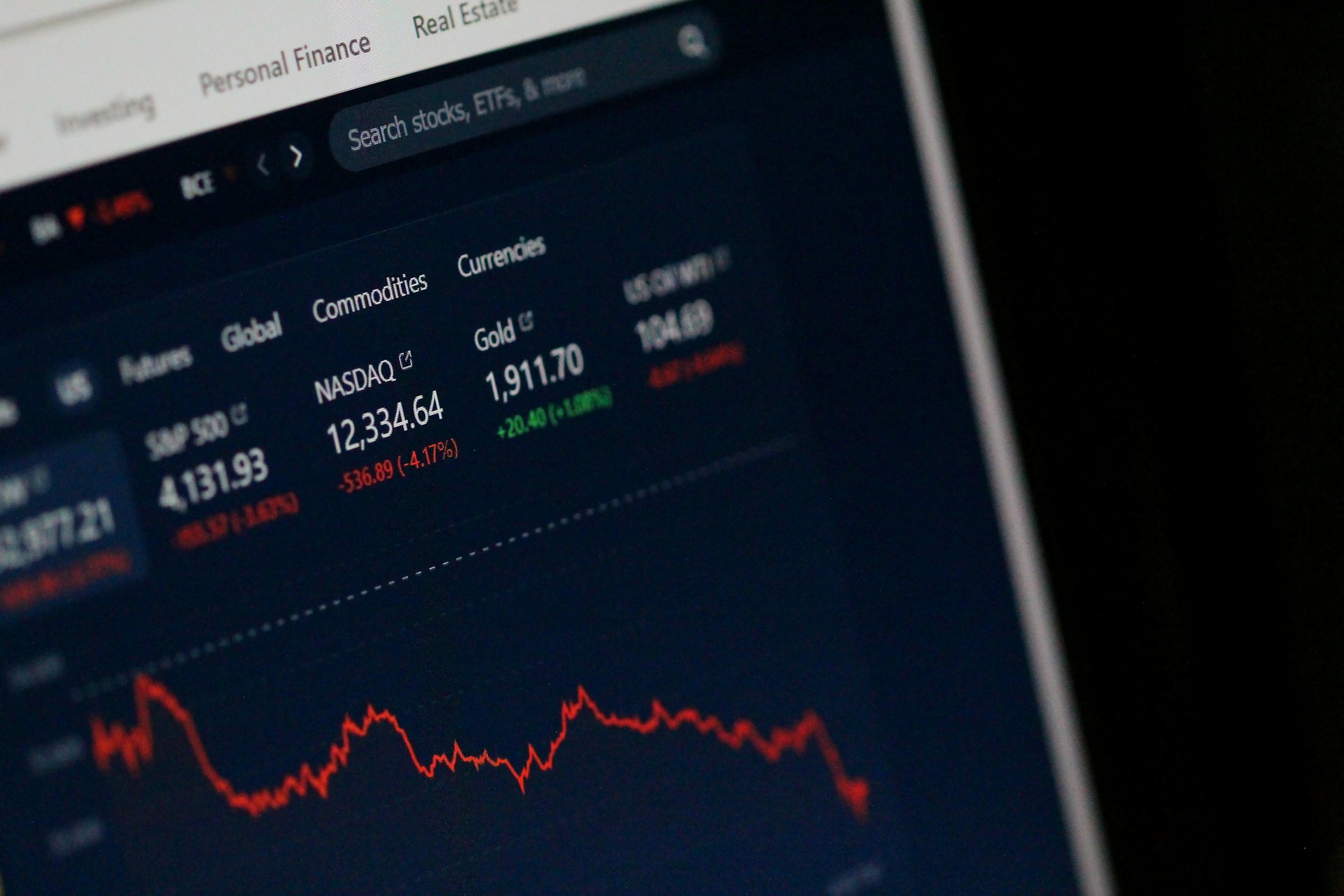

Asian stocks advanced on Tuesday while the U.S. dollar slipped, as investors anticipated the Federal Reserve would restart its rate-cutting cycle this week. Markets are fully pricing in a 25-basis-point cut at Wednesday’s meeting, with traders also awaiting the Fed’s updated “dot plot” and comments from Chair Jerome Powell for clues on the pace of future easing.

MSCI’s Asia-Pacific index outside Japan climbed to its highest level in more than four years, up 0.3%. Japan’s Nikkei and Topix also hit fresh records. Optimism about rate cuts has buoyed risk sentiment, though analysts warn that with 127 basis points of cuts already priced in through mid-2026, any hint of a hawkish stance could unsettle markets.

In the U.S., Senate confirmation of Stephen Miran to the Fed board and a court ruling protecting Governor Lisa Cook’s position had little market impact. Meanwhile, futures showed muted moves: Eurostoxx 50 slipped 0.09%, FTSE rose 0.08%, and U.S. indexes hovered near record highs after overnight gains.

Tech stocks were in focus as Nvidia shares eased following China’s accusation of anti-monopoly violations, escalating trade tensions. However, Washington and Beijing reported progress on a framework for shifting TikTok to U.S.-controlled ownership, with confirmation expected in an upcoming Trump-Xi call.

Currency markets reflected dollar weakness, with sterling steady at $1.3599 and the euro at $1.1758, close to recent highs. The Australian dollar jumped to a 10-month peak at $0.6677, supported by Fed cut bets and easing trade concerns.

In commodities, Brent crude rose 0.25% to $67.59, while U.S. crude gained 0.22% to $63.44 amid concerns over Ukrainian drone strikes on Russian refineries. Spot gold reached a record $3,689.27 an ounce, fueled by dollar softness and Fed expectations.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility