With cryptocurrency prices declining further amid mild rallies in December and Bitcoin prices in particular oscillating between the range of $3200 – $4400 mark, we provide an update on some important cryptocurrency flow metrics.

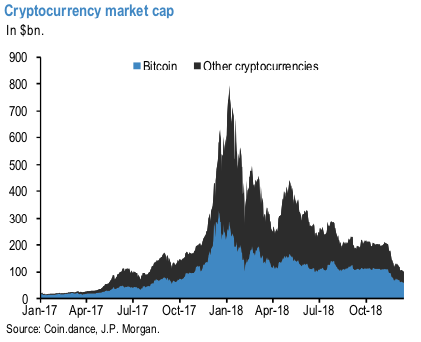

As a result of continued price declines, the market value of cryptocurrencies has dropped further to $100bn from its alluring value of $500bn-800bn during the beginning of the year. Let’s just quickly glance back at the value in Q3’2017 to observe such market value for the cryptocurrency universe (refer above chart).

Furthermore, Bitcoin’s lion’s share of entire market cap of the cryptocurrency gamut has increased again in during last December to above 57% compared to an all-time low of around a third at the turn of the year, meaning that other cryptocurrencies continue to suffer disproportionately during this correction phase. 57% was the share of Bitcoin back in May 2017. Courtesy: JPM

Trade tips: At spot reference: 3749.40 levels, on trading grounds, one can initiate BTCUSD boundary option spread strategy with upper strikes at 3900 and lower strikes at 3550 levels.

The trading between these strikes likely to derive certain yields in this perplexed trend in the short term, more importantly, these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 3900 > Fwd price > 3550 levels).

Alternatively, one could initiate long positions in CME BTC futures contracts of near month tenors with a view of arresting upside risks.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards -95 levels (which is bearish), while hourly USD spot index was at 37 (mildly bullish) while articulating (at 10:10 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025