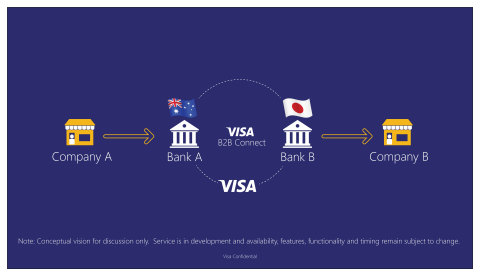

Visa Inc. has announced a preview of its international Visa B2B Connect, a new platform that is being developed to provide financial institutions simple, fast and secure way to process B2B global payments, built on Chain’s blockchain technology.

According to the official release, the company is working with Chain and using its Chain Core, which is an enterprise blockchain infrastructure facilitating financial transactions on scalable, private blockchain networks. Blockchain technology will enable Visa to develop a new near real-time transaction system designed for the exchange of high-value international payments between participating banks on behalf of their corporate clients.

“The time has never been better for the global business community to take advantage of new payment technologies and improve some of the most fundamental processes needed to run their businesses. We are developing our new solution to give our financial institution partners an efficient, transparent way for payments to be made across the world,” Jim McCarthy, executive vice president, innovation and strategic partnerships, Visa Inc said.

Visa B2B Connect will be managed by Visa end-to-end and will ease a steady process to handle settlement through Visa’s standard practices. With its B2B solution, the company is planning to deliver clear costs, improved delivery time and visibility into the transaction process, thus improving the way international B2B payments are made today. It will reduce the investments and resources that banks and corporate clients require to send and receive business payments.

“This is an exciting milestone in our partnership with Visa. We are privileged to support Visa’s efforts to enhance the service it provides to its clients and shape the future of international commerce with this blockchain-enabled innovation – streamlining business payments among financial institutions and their customers around the world,” Adam Ludwin, chief executive officer of Chain said.

Visa launches Visa B2B Connect built on Chain’s blockchain technology

Visa B2B Connect (EconoTimes)

Friday, October 21, 2016 12:50 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary