Germany’s economic performance has been the driving force of the euro area’s recovery so far, and upbeat business confidence in October suggests that the German economy is on track for more robust growth. Brexit vote had temporarily unsettled companies in Germany, but recent data show signs of upward trend.

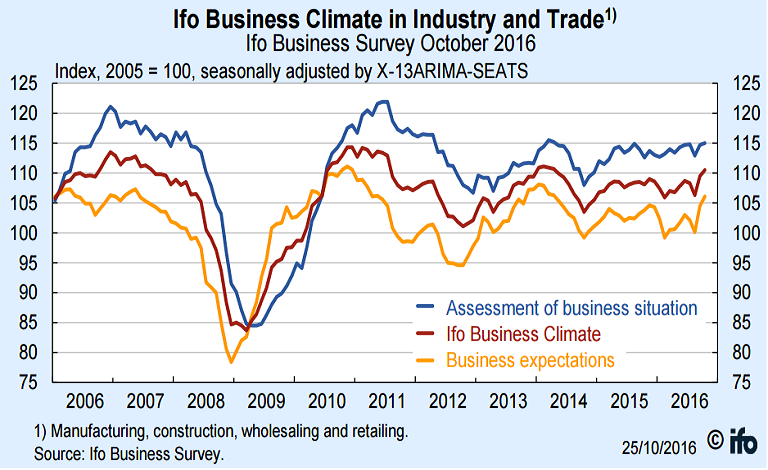

Data released on Tuesday by the Munich-based Ifo institute, showed that German business confidence in October improved to the highest level since April 2014, signalling uncertainty over Brexit continued to abate. German business climate index climbed to 110.5 from 109.5 in September, Business Expectations Index rose to 106.1 from 104.5 and Current Assessment Index increased to 115.0 from 114.7.

German GDP data is due on Nov. 15 and economists surveyed by Bloomberg expect Q3 GDP growth of 0.3 percent after 0.4 percent in the previous three months. However, the Bundesbank in its 'Monthly Report' released on Monday, has dismissed weaker growth in Q3 as temporary and said that underlying momentum remains strong. Export and business expectations in manufacturing suggest the situation could improve in the coming month, the central bank added.

Latest German data overall has also suggested a significant improvement at the start of the fourth quarter. The latest German PMI data, released on Monday, showed a strengthening in the manufacturing sector to a 33-month high and a notable recovery in the services sector. German out-performance would certainly complicate ECB policy making and Bundesbank opposition to an extension of bond purchases would tend to intensify.

While Germany’s economy may be headed for a pick-up, data suggest that the rest of Europe will continue expanding at a slower pace. Separate report released by official statistics office INSEE on Tuesday showed that France manufacturing confidence dropped slightly to 102 in October from 103.

"In Germany, growth may even have accelerated toward the end of the year. With other parts of the eurozone, particularly France and Italy, performing far worse than their larger neighbor, the ECB will remain under pressure to offer more policy support to achieve its region-wide inflation goal,” said Jennifer McKeown, chief European economist at Capital Economics.

EUR/USD largely muted on upbeat German Ifo data. The pair was 0.04 percent lower, trading at 1.0875 at around 12:00 GMT.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions