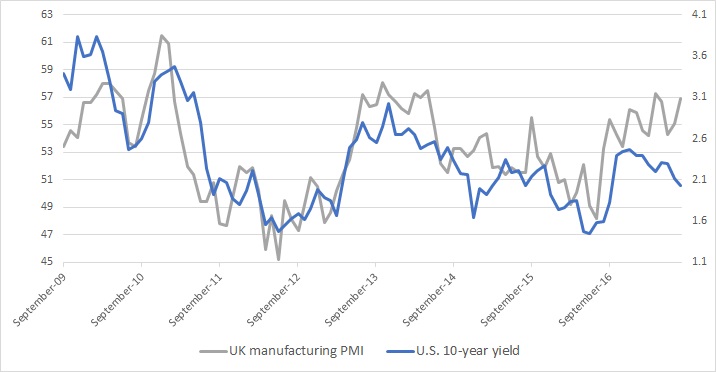

The above four charts show the relation between U.S. 10-year yields and manufacturing PMI numbers from the United States, Switzerland, Eurozone, and United Kingdom. We have chosen U.S treasury as a representative of global yield due to the importance of the U.S. dollar in the global financial system. Even if we had chosen 10-year yield from each region, the outcome wouldn’t be starkly different.

All four charts are showing the close relationship between the manufacturing PMI and 10-year yields, which is not surprising given the fact that central banks do not have much influence on the long term yields, unlike the short-term yields. Long-term yields like 10-years depend on the inflation outlook, state of the economy, savings glut etc.

All four charts have recently been flashing warning signs. A continuing divergence is quite visible for all four charts; extreme for Eurozone. It can be seen that while manufacturing PMI is moving higher, the 10-year treasury yields have been moving lower. For the United States, the divergence began last December and still continuing. For Eurozone, it began back in September 2015. For the UK, the divergence began in 2015, it closed somewhat last year but the gap started widening again since December. For Switzerland, the divergence began December last year and still growing.

While a divergence is n not an all new phenomenon, as can be seen in the chart of U.S. ISM manufacturing PMI and 10-year yields. Back in 2014, a divergence occurred. From March to October 2014, while PMI grew, U.S. treasury yield headed lower. But the divergence collapsed with a slowdown in the economy. So the real question is ‘what will happen this time around? Will yields move higher or will economy slow down?’

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility