Deutsche bank recommended to sell all emerging market currencies over rise in Dollar, especially emerging market Asia and China. So we take a look, how EM Asia has performed in latest Dollar leg and is it fair to go short in all?

This Dollar leg, can be broken in two segment,

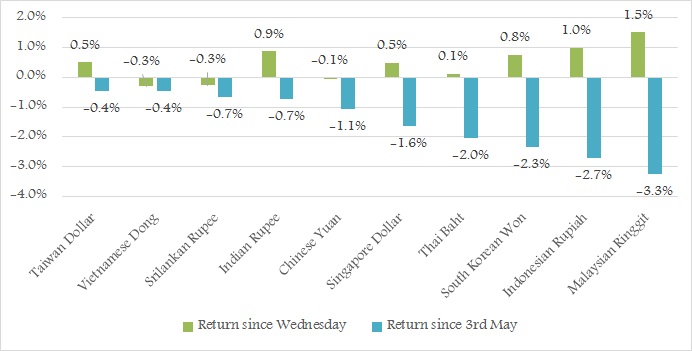

- Performance since May 3rd, when Dollar index bottomed and

- Performance since May 25th, Wednesday, from where Dollar suffered sharp selloffs

The result is shown in figure.

- Biggest loser in the latest bull leg has been Malaysian Ringgit (-3.3%), followed by Indonesian Rupiah (-2.7%), South Korean Won (-2.3%), Thai Baht (-2%), Singapore Dollar (-1.6%), Chinese Yuan (-1.1%).

- Biggest gainers in last Dollar retracement has been Malaysian Ringgit (+1.5%), followed by Indonesian Rupiah (+1%), South Korean Won (+0.8%), Indian Rupee (+0.7%).

In both of the above scenario, losers have been Chinese Yuan, Srilankan Rupee, and Vietnamese Dong.

Looking at the return and lining the fundamentals,

We would recommend, going short in Chinese Yuan, South Korean Won, Indonesian Rupiah and Singapore Dollar. Fundamental is also falling in line. Weakness in China and rest to suffer due to their large exposure.

Malaysian Ringgit is recommended on the short side but oil price will be a key influence for this one.

We prefer going long in Indian Rupee, against other EM currencies. However China weakness likely to hit INR too.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX