In the press conference following this week's ECB meeting, Mario Draghi stated that the market should get used to periods of high volatility, implying that he wouldn't be leaning against the recent pickup in bund yields. This led to a powerful sell-off in European fixed income, with Treasuries following in tow.

Data from the ISM surveys was mixed, while the Beige Book indicated a steady pace of expansion from the first quarter. Still, there were signs of optimism with May auto sales reaching a ten-year high of 17.7 million units.

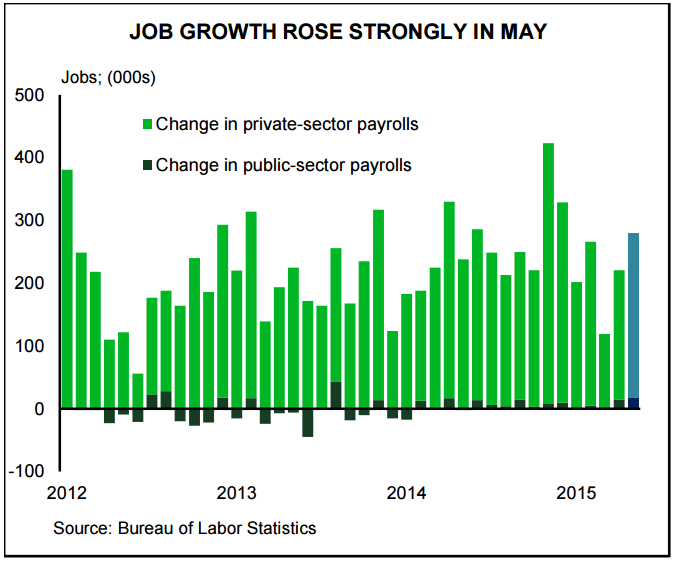

Optimism received another boost on Friday, with non-farm payrolls rising 280k in May, smashing expectations for 226k. Average hourly earnings rose 0.3% month over month, and combined with the growth in payrolls, aggregate wages expanded a robust 0.6% on the month.

The bottom line is that the continued strength in the labor market combined with evidence that economic growth is probably not quite as weak as it appears and now improving, suggests that the Fed should still be on track to finally nudge interest rates higher. While the June meeting is more than likely off the table, September is still very much in play.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX