At its eleventh and final monetary policy meeting of 2016, the Reserve Bank of Australia (RBA) left interest rates on hold at a historic low of 1.5 percent as widely expected. The statement that followed had only few minor changes, although the board did flag the prospect of a near-term slowdown in economic growth, noting that “some slowing in the year-ended growth rate is likely, before it picks up again”.

The board’s language on the outlook for inflation and the labour market was similar to that conveyed in November, although there were a few noticeable tweaks made to its view on the housing market. On the labour market, an area of particular focus given weak wage and employment growth and elevated levels of underemployment, the board said recent indicators “continue to be somewhat mixed”.

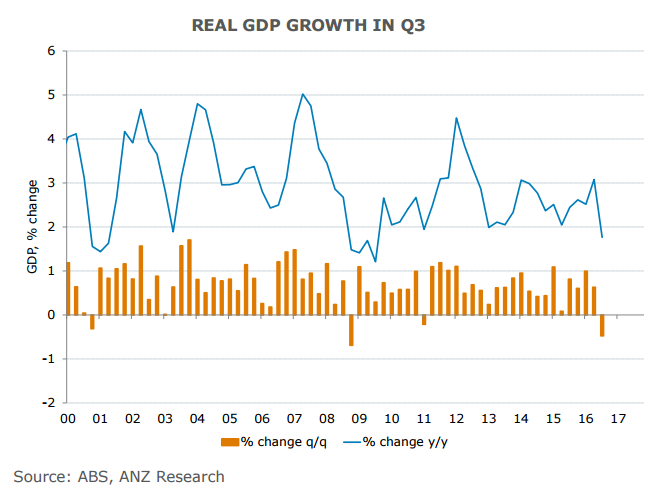

Australia's third quarter Gross Domestic Product (GDP) outcome released earlier on Wednesday was a shockingly weak result. Australian economy shrank 0.5 percent q/q and on a y/y basis growth slipped to 1.8 percent from a downwardly revised 3.1 percent in Q2. GDP report implies certain loss of momentum in the economy, in line with the deceleration in employment growth. That said there are a number of temporary elements to the weakness which are expected to bounce back in Q4.

Most analysts think GDP will be positive in the fourth quarter and the country will likely avoid a technical recession. But some still expect the Reserve Bank to cut the cash rate in 2017 to 1 percent. Markets are currently pricing in a 12 percent chance the RBA will hike rates in 2017.

"Unexpectedly weak Australian Q3 GDP figures keep alive the possibility that the RBA – which left rates unchanged at 1.5% yesterday – may cut interest rates, perhaps early next year. More data, however, is likely to be needed before it decides to do so." said Lloyds Bank in a report.

At 1200 GMT, FxWirePro's Hourly Currency Strength Index of Australian Dollar was slightly bullish at 88.7062, while the FxWirePro's Hourly Strength Index of US Dollar was neutral at -43.5753. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal