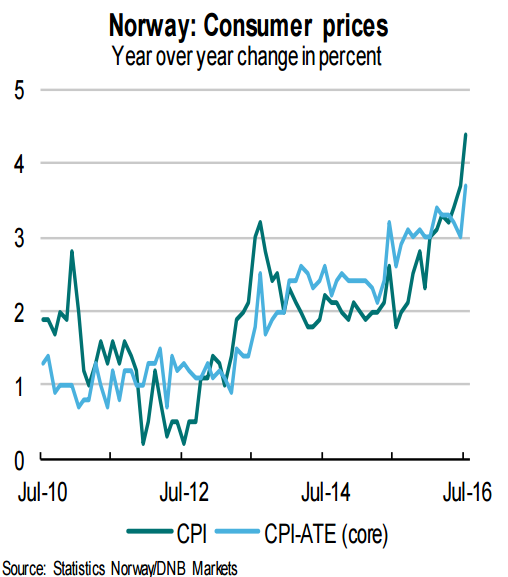

Norway's core inflation surged to record highs in July, dampening Norges Bank’s rate cut speculation. Norway's core inflation, as measured by the CPI-ATE unexpectedly surged to 3.7 percent y/y in July, up from 3.0 percent in June and way above consensus expectation at 3.1 percent. Prices in July rose at the highest rate since at least 2000, according to a statement from Statistics Norway.

The rise in prices has been quite broad-based, indicating that inflation will remain higher than expected for an extended period. Strong rises were seen especially in food prices, but transport prices also rose significantly. Inflation is now higher than Norges Bank's forecast for two consecutive months.

The Norwegian central bankers expect that the weak economy, as well as a stronger krone, will eventually dampen inflation pressure. That said the Norges Bank has not been very accurate with its inflation projections over the past months. Indeed, the krone has appreciated by around 3 percent on a trade-weighted basis since the start of the year. However, the inflation trend has accelerated rather than weakened and is now well above Norges Bank’s projections.

Can Norges Bank really afford another rate cut? At their June meeting, Norwegian policy makers left their key rate at 0.5 percent and raised their outlook expecting a rebound in crude to stimulate growth, consumption and investments. Recent data does point to an improvement in the Norwegian economy. Production levels have bottomed out and an increase in unemployment has stalled, signaling the worst may be over. However, the surge in inflation dampens any rate cut speculation for now.

“There are good reasons to believe the announced rate cut in September is off the table,” Marius Gonsholt Hov, an economist at Svenska Handelsbanken AB in Oslo, said in a note. “Even if the figures are volatile during the summer months, it will take a lot to correct this error in August.”

Norway’s currency surged on Wednesday as strong inflation data takes an interest-rate cut off the table. EUR/NOK slumped to hit fresh 2-month lows after inflation data. The pair is trading largely unchanged on the day at 9.2266 at around 11:00 GMT. Momentum is bearish. We see scope for test of 9.1500 levels.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?