The USD/TWD currency pair is anticipated to trade at around 32.2 in the run-up to the United States Inauguration Day, to be held on January 20, 2017. This day is celebrated once in every four years and in the year following the country’s Presidential elections.

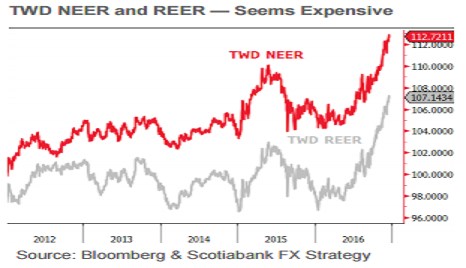

Currently, the TWD remains expensive in terms of either NEER or REER. In the months ahead, the TWD will trade in response to the Fed’s tightening pace, Trump’s protectionist trade policies, potential spillovers of the yuan depreciation and future developments in cross-strait relations, Scotiabank reported.

Potential spillover effects of the yuan depreciation may weaken the TWD, considered a proxy to the yuan. On the campaign trail, Trump vowed to label China as a currency manipulator and impose a 45 percent tariff on imports from China.

Further, geopolitical uncertainty is likely to increase if Trump doesn't moderate his China rhetoric. Cross-strait relations that have cooled but stayed calm so far are less likely to improve in the foreseeable future, which may weigh on the Taiwanese economy.

Also, Trump’s protectionist trade policies will undermine some regional currencies of export-oriented economies such as the TWD.

Meanwhile, USD/TWD traded at 32.00, up 0.12 percent at 7:15GMT.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns