A stronger-than-expected first half of the year prompts us to upgrade our Canadian GDP growth forecast for 2017 to 2.9 percent. Solid growth is being complemented by a healthy labor market, the latter creating jobs in numbers not seen in 7 years. That, coupled with the housing wealth effect ─ consumer credit growth is surging thanks in part to home equity lines of credit ─ is boosting consumption.

The national bank of Canada also raised calls for 2018 growth from 2.0 percent to 2.5 percent to reflect provincial fiscal stimulus in British Columbia but also in Ontario and Quebec ahead of elections in the latter two provinces. The improving outlook and growing financial stability risks associated with housing and household debt arguably take precedence over the problem of low inflation, and hence warrant tighter monetary policy from the Bank of Canada.

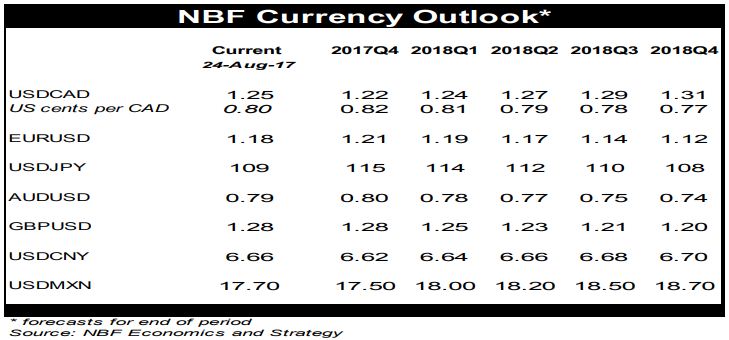

In light of the slightly more bullish call on Canada, the NBC now expect the Bank of Canada’s overnight rate to end 2018 at 1.75 percent, 25 basis points higher than in our previous forecasts. As such, we are a bit more optimistic about the Canadian dollar, now expecting USDCAD to trade in the 1.20-1.30 range over the next 12 months.

The sixth largest commercial bank in Canada has also raised targets for the euro to reflect an improved economic outlook on the old continent. So, the trade-weighted US dollar is likely to remain under pressure for a while longer. But the greenback could find renewed strength in 2018 if, as the commercial bank expect, the Fed surprises markets with a couple of interest rate hikes next year.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk