The Canadian dollar has fallen against the USD over the past month. However, it is little changed against sterling and has risen versus the euro, which suggests that domestic fundamentals had little to do with the move. The BoC left interest rates unchanged after its 21st October policy meeting and sounded cautiously optimistic about the outlook.

It seems unlikely that the BoC would immediately match a December rise in US interest rates. However, the gradual upward path for US rates expected from here probably limits the scope for further cuts in Canadian rates and increases the likelihood that the BoC will start to tighten policy sometime in 2016. The likelihood that the new Liberal government will pursue a looser policy than its Conservative predecessor may also limit the need for the BoC to ease further.

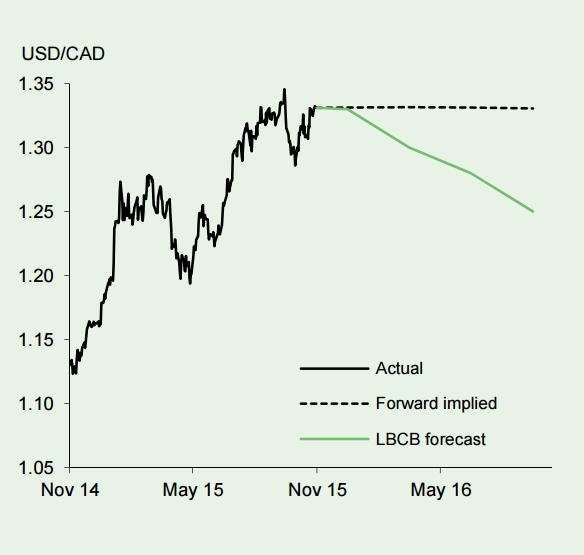

Signs that oil prices are stabilising and will pick up through next year could provide a further support for the 'loonie'. In the near term, there remains a significant risk that the CAD will fall further, particularly against the USD. However, it is close to a bottom and the most will probably start to appreciate gradually through 2016, reaching 1.22 against the USD by year end.

USD/CAD Outlook

Tuesday, November 17, 2015 11:47 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022