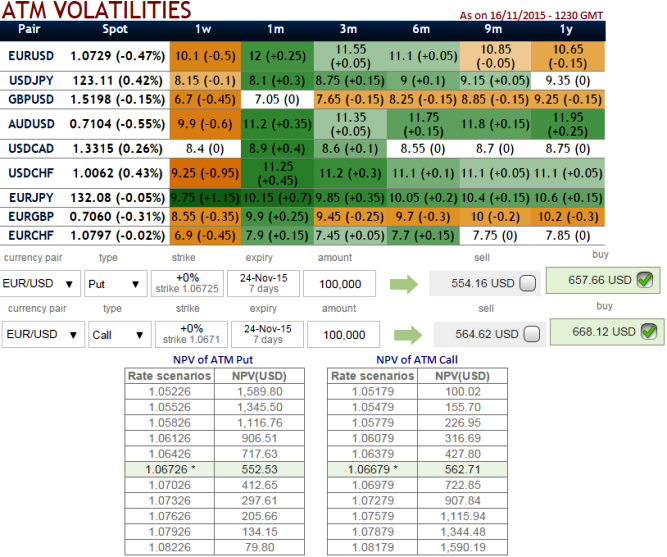

The implied volatility of ATM contracts for near month expiries of this the pair is at around 8.9% and for 1w expiry at 8.4%.

NPV of 1w ATM put is 552.60 while premiums trading above 19.02% at USD 657.67 for lot size 100,000 units.

NPV of 1w ATM call is 562.93 while premiums trading above 18.68% at USD 668.12 for lot size 100,000 units.

Hence, comparing this difference in options premium with implied volatility and market upward sentiments we think the hedging cost for downside risks would not be economical as result of deploying ATM instruments considering short term downswings.

But we cannot afford to get stuck in this riddle without hedging, so what's the alternative, in forwards markets at least..?, subsequently, here comes the strategy arbitrage strategy in which options trading that can be performed for a riskless profit as USDCAD ATM call options are overpriced relative to the underlying exchange rate of USDCAD.

To perform this conversion, the hedger holds the underlying spot FX and offset it with an equivalent synthetic short spot FX (long put + short call) position.

Profit is locked in immediately when the conversion is done, the profit would be strike price of call/put - purchase price of underlying + call premium - put preium.

FxWirePro: Offsetting USD/CAD via option arbitrage as NPV of ATM puts seem costlier

Tuesday, November 17, 2015 12:02 PM UTC

Editor's Picks

- Market Data

Most Popular

5