Today, U.S. Labor Department will release much anticipated non-farm payroll report. On Wednesday, ADP employment report was released and it was a blockbuster report. The report indicated that the Trump effect is quite prevalent in the Labour market. One of the biggest promises of Donald Trump was to create jobs, especially for Middle America, which used to rely heavily on manufacturing and mining jobs but since 2001, and especially after the 2008/09 Great Recession jobs in the manufacturing sector in the United States the sector has shed more jobs than it created. Trump has promised to reverse the course by bringing back manufacturing back to the United States.

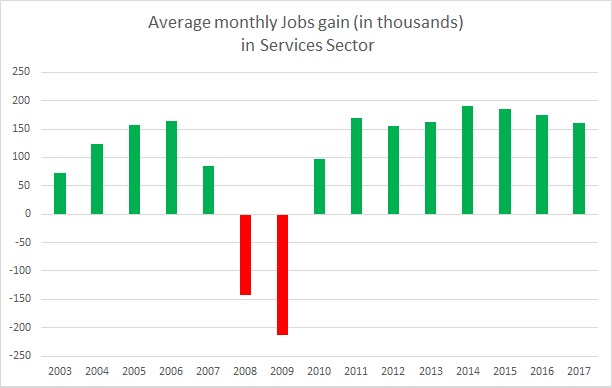

These above charts show based on ADP employment data, how the Labour market is performing this year compared to history,

- The first chart shows average monthly job creation in the services sector and one can see that job creation is on a downward path for last few years. So far this year, Services sector created 161,000 jobs every month on an average, which is the weakest figure since 2011.

- However, the second chart shows that the economy created 212,000 jobs on an average every month this year, which is the highest since 2014.

- And the credit goes to the Goods-producing sector (Chart 3), which created 51,000 jobs on an average per month, which is the highest since at least 2003.

- Manufacturing sector created 17,000 jobs on an average per month, which is the highest since 2014.

- Construction sector created 30,000 jobs on an average per month, which is the highest since 2005.

If President Trump is able to follow through his promise and create blue collar jobs, his reelection for a second term is only a matter of time.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns