US-based manufacturing firms remained in expansion mode in July, flash estimates released by IHS Markit showed on Monday. Overall business conditions improved at the fastest pace for four months, while private sector output expanded at the fastest rate in six months in July, according to flash estimates.

The seasonally adjusted IHS Markit Flash US Manufacturing Purchasing Managers' Index (PMI) rose to 53.2, from 52.0 in the previous month, supported by accelerated growth in output, new orders and employment. On the other hand, services PMI stood at 54.2 in July, unchanged from the previous month, on the back of an improving economic backdrop and greater willingness to spend, IHS Markit said in a statement yesterday.

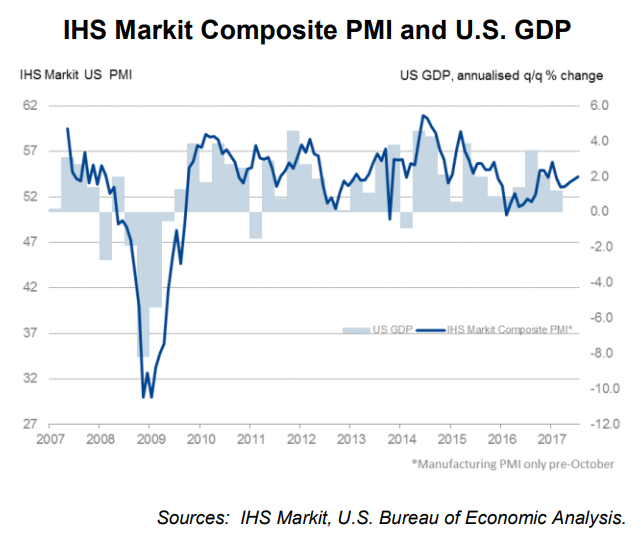

The composite PMI was 54.2 from 53.9 in June, signalling the strongest rate of expansion since January, IHS Markit stated. A robust expansion in new business intakes led to stronger job creation and a sustained rise in volumes of work outstanding in July. July data also pointed to a slight rebound in input cost inflation from the 15-month low seen during June.

“The July PMI surveys show an economy gaining growth momentum at the start of the third quarter. The surveys are historically consistent with annualized GDP growth of approximately 2%, but the signs are that growth could accelerate further in coming months," said Chris Williamson, Chief Business Economist at IHS Markit.

Meanwhile, home re-sales fell more than expected last month as a dearth of properties lifted prices to a record high, according to the National Association of Realtors. Data showed that existing home sales dropped 1.8 percent to a seasonally adjusted annual rate of 5.52 million units last month.

Investors remain cautious ahead he Federal Open Market Committee (FOMC) monetary policy meeting, scheduled to be held on July 26. With no policy change expected in July, the focus for markets will be on whether the Fed sends any new signals about its intentions for the rest of the year.

S&P 500 Futures traded 0.19 percent higher at 2,473.00 by 1110 GMT. DXY was largely muted at 93.96 levels. FxWirePro's Hourly Dollar Strength Index remained highly bearish at -123.83 at 1110 GMT (A reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances