The Australian dollar has seen notable appreciation since the start of the year. AUD had almost reached alarming heights of around A$0.79 against the USD, when the RBA reacted in May and as recently as in August and lowered its key rate by 25bp respectively to a historic low of now 1.50 percent.

The Reserve Bank of Australia (RBA) has repeatedly said in its statements that a strong AUD could “complicate” the process of necessary economic adjustments as structural changes away from the mining sector and towards other sectors are progressing. Strong AUD puts pressure on the inflation outlook and remains a thorn in the RBA’s side.

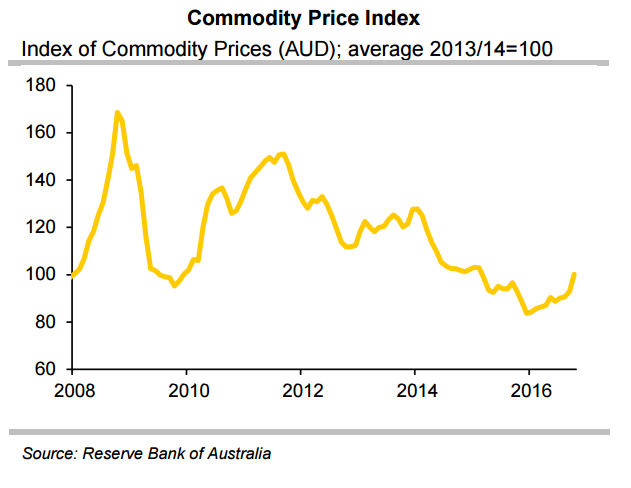

Falling commodity prices put considerable pressure on the Australian terms of trade and a weaker currency would help to compensate for the negative effects. In addition, weaker AUD puts upward pressure on inflation by increasing import prices and hence desirable by the central bank.

After Donald Trump’s surprise election victory, inflation expectations in the USA have spiked. Markets are now fully pricing in a rate hike by the Fed at its December meeting and this is allowing the USD to appreciate significantly against the AUD. The interest rate differential to the “high interest” currency will widen since the Fed will hike the key rate in December.

That said, commodity prices are recovering and the RBA is unlikely to raise rates in the coming quarters which is likely to keep the AUD supported. Assistant Governor Christopher Kent speaking at the Australian Business Economists Conference Dinner on Tuesday said that he reasonable prospects for overall strong economic growth. Kent said that Australia’s mining states’ prospects are improving as the drag on economic growth from falling resource investment eases and a boost in commodity prices brings windfall cash.

Nevertheless, Commerzbank expects the effect of US interest expectations to overweigh and ensure that the AUD slowly depreciates against the USD. AUD/USD was trading at 0.7410 at 1200 GMT. Technical studies show further downside for the pair. Price has dropped below major 200-day MA and is biased lower.

FxWirePro's Hourly AUD Spot Index was at 77.1604 (Slightly bullish), while Hourly USD Spot Index was at -28.727 (Neutral) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out