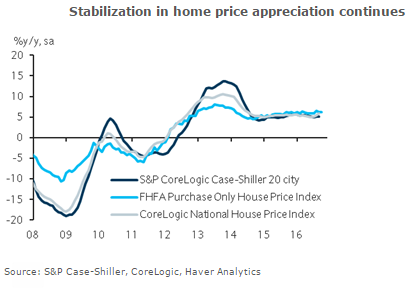

Home prices in the United States continued to witness steady gains during the month of October, remaining consistent with other home price indices. The indicator is expected to maintain the pace going into 2017.

US’ FHFA purchase-only House Price Index rose 0.4 percent m/m in October, a touch lower than consensus estimates of 0.5 percent, taking the y/y growth to 6.2 percent, around the same pace recorded at the turn of the year, data released by the Office of Federal Housing Enterprise Oversight (OFHEO) showed Thursday.

Prices gained in all the regional sub-components barring West N. Central fell -0.2 percent and East S. Central dropped -0.6 percent. The largest increases came from Mountain and New England. On the whole, today’s data are consistent with trends in other home price indices, which show annual home price appreciation stabilizing between 5-6 percent since 2015.

"We expect home prices to continue appreciating at a steady and modest pace for the rest of 2016 and 2017," Barclays Research said in its latest report.

Meanwhile, the dollar index traded at 103.01, down -0.08 percent, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -8.36 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances