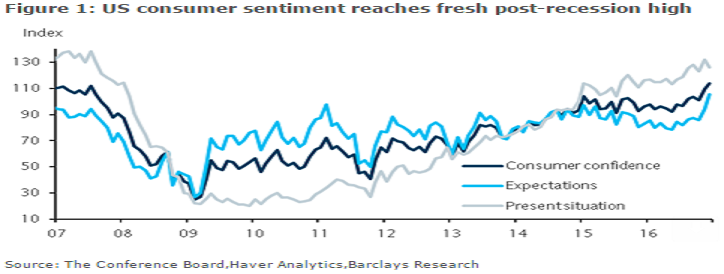

Consumer confidence in the United States remained upbeat during the month of December, jumping more than what markets had initially anticipated, in a signal that the moderation in the world’s largest economy will continue to boost household spending during the last quarter of this year.

The U.S. Conference Board’s index of consumer confidence rose to 113.7 in December, compared to 107.1 in November, extending the previous month’s gains. Although confidence was expected to improve further this month, the outturn was significantly higher than market expectations.

Consumer confidence reached a fresh post-recession high to 105.5, driven by a significant rise in consumer expectations, from previous 94.4. However, the present situation index, declined in December to 126.1, from previous 132.0.

The labor market differential, which measures the net share of consumers that saw employment as plentiful, eased lower to 4.4, compared to 6.6 previously, but it remains higher than the long-term average.

"On the whole, today’s report suggests that household confidence remains on a strong footing, and we view this as constructive for consumer spending in Q4," Barclays commented in its latest research report.

Meanwhile, the dollar index traded at 102.97, down -0.05 percent, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -12.95 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains