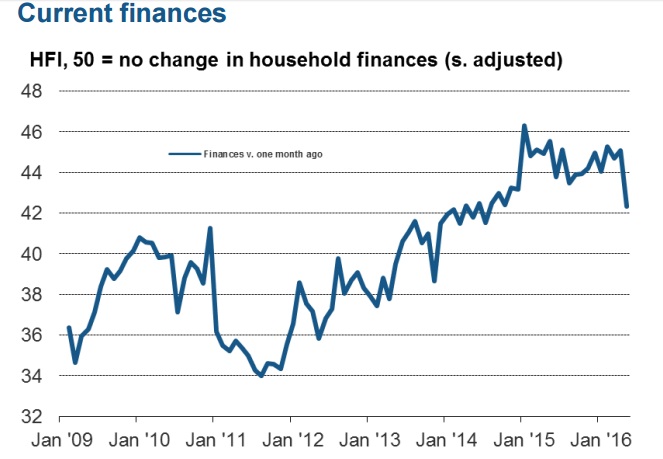

According to survey conducted by Markiteconomics, UK Household finance index (HFI), which is a perceptive measure of financial wellbeing has dropped to 22 month low, ahead of Britain’s referendum over EU.

According to Markit, “For the first time since August last year, financial perceptions worsened in each of the eight monitored job sectors. Those working in media/culture/entertainment were the most downbeat, closely followed by retail employees”. In May the index dropped to 42.3 from 45.1

Key reasons behind the drop has been higher inflation perception, which is strongest since December 2014, lower wage growth and pressure on savings.

According to economist, situation is likely to worsen far from her, if Britons choose the exit path in June referendum. In such a scenario, investments, both domestic and foreign likely to drop, pressuring wages through job losses, higher inflation due to drop in Sterling and uncertainties regarding trade. In the short –run, according to most Brexit is likely to be an economic storm.

Pound is currently trading at 1.453 against Dollar.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions