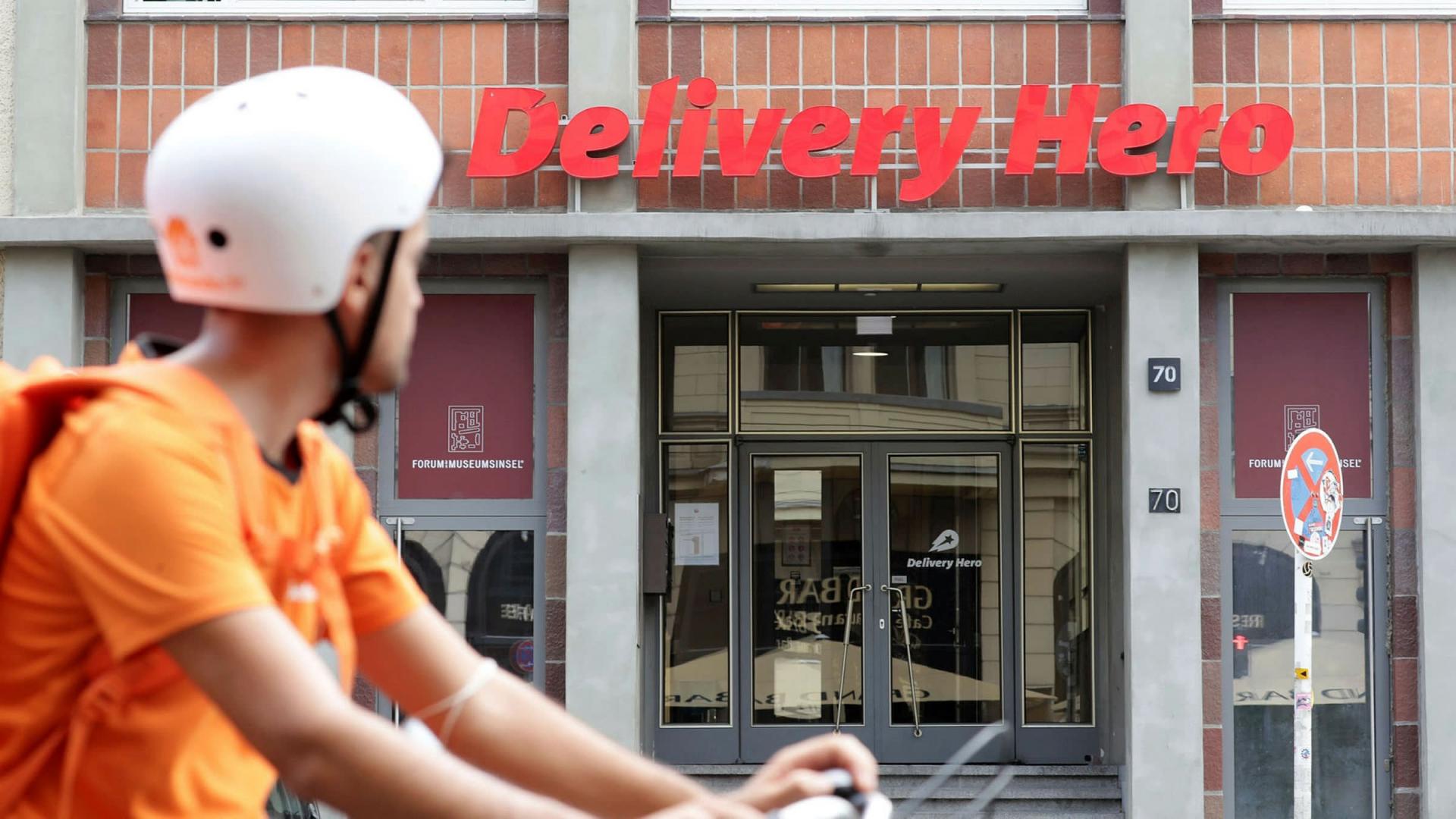

A food delivery industry source warned the Korea Fair Trade Commission (FTC) that German firm Delivery Hero can delay the sale of Yogiyo and raise the market share of Baemin to the fullest while it operates both firms for up to six months.

Emphasizing that the FTC needs to supervise Delivery Hero, closely, it added that the German firm can also try to combine with another food delivery player while its market share grows in the meantime.

The FTC had asked Delivery Hero to sell Yogiyo within six months if it wants to pursue a merger with Woowa Brothers, the operator of No.1 food delivery service Baemin or Baedal Minjok.

Delivery Hero said it will first settle the merger deal with Woowa Brothers within the first quarter of next year before selling off Yogiyo.

Coupang, Naver, and Kakao have emerged as top candidates to take over South Korea's No. 2 food delivery player Yogiyo.

Domestic retail giants like E-Mart and Lotte are also tapped as possible candidates to take over Yogiyo. E-Mart is said to have started internally reviewing that possibility.

Yogiyo, which accounts for 18 percent of the local market share, has an estimated market value of 2 trillion won, excluding the control premium.

An industry source said Yogiyo is an especially attractive firm for Coupang as it can achieve synergy with its own delivery service.

Coupang currently runs its own food delivery service, Coupang Eats, which comprises a 3.1-percent market share to rank third-largest.

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins

DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO

Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Taiwan Says Moving 40% of Semiconductor Production to the U.S. Is Impossible

Taiwan Says Moving 40% of Semiconductor Production to the U.S. Is Impossible  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns