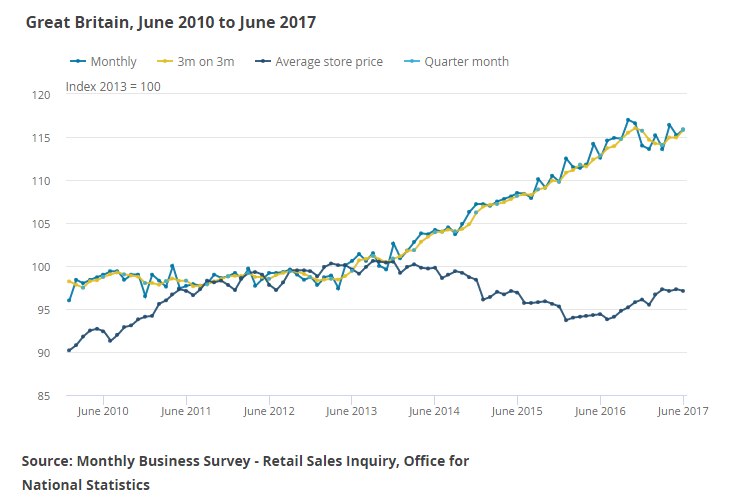

UK retail sales retraced most of May's decline and rose more than expected in June. According to data released by the Office for National Statistics (ONS) on Thursday, UK retail sales volumes rebounded by 0.6 percent m/m in June after a downwardly-revised 1.1 percent decline in May, beating consensus expectations for a rise of 0.4 percent. The annual growth rate recovered strongly to 2.9 percent from 0.9 percent.

Details of the report showed increases were recorded in most of the main categories of spending. The warmer weather in June is likely to have boosted sales in those areas that are more sensitive to changes in weather patterns. The largest rise in sales was seen at household goods stores which saw 3.3 percent m/m rise. Sales at clothing sales rose 0.4 percent m/m, while food sales slumped 0.5 percent m/m.

"We shouldn't get too carried away by these figures. After all, the retail sales figures are very volatile on a month-by-month basis. And the heat wave in June provided a boost to clothing sales that may not be sustained," said Paul Hollingsworth, UK economist at Capital Economics.

Overall, today’s data provides additional support to GDP growth in Q2. Analysts at Lloyds bank said, ahead of next week’s preliminary estimate of Q2 GDP, the 1.5 percent rise in retail sales in the second quarter alone, should add around 0.1 percent points to GDP growth in Q2. Nevertheless, the hurdle to sustained consumer-led growth continues to remain high. The underlying picture of an economy that seems to be losing momentum as we head into the second half of the year still remains unchanged.

“With the economy showing signs of losing momentum and inflation showing a surprise fall to 2.6%, the latest data suggest that August could well see the Bank of England revise down its forecasts for the economy and put to bed the prospect of a rate hike any time soon, albeit with the door left open for a tightening of policy if the economic data surprise to the upside," said Chris Williamson, Chief Business Economist, IHS Markit.

Cable has broken major psychological at 1.3000 despite better than expected U.K retail sales. Major resistance is seen around 1.3130 and any break above confirms bullish continuation. The near term resistance is around 1.3000/1.30618. We see near term support around 1.2960 (10-day MA) and any break below will drag the pair till 1.2857 (daily Kijun-Sen)/1.28118 (Jul 12th low).

FxWirePro's Hourly GBP Spot Index was highly bearish at -188.552 levels at around 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran