The United Kingdom’s manufacturing sector started the final quarter of the year on a solid footing. Production and new order volumes continued to rise at robust rates, as companies benefited from strong domestic market conditions and rising inflows of new export business.

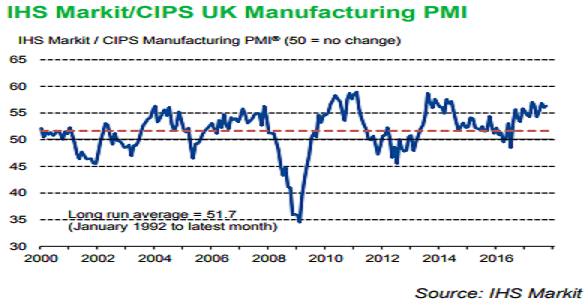

The seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index (PMI) registered 56.3 in October, up from 56.0 in September (revised from the original reading of 55.9). The headline PMI has now signaled expansion for 15 consecutive months. Responses from the latest survey were collected between October 12-26.

UK manufacturing production rose at an identically solid pace to that registered in the prior survey month during October. The expansion was broad-based by sub-sector, with consumer, intermediate and investment goods producers all registering output growth.

"The continued robust health of manufacturing and rising price pressures will help cement expectations of the Bank of England hiking interest rates for the first time in a decade as Thursday’s announcement approaches," said Rob Dobson, Director at IHS Markit.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility