Manufacturing activity in the United Kingdom declined during the month of October, remaining slightly below what markets had initially anticipated.

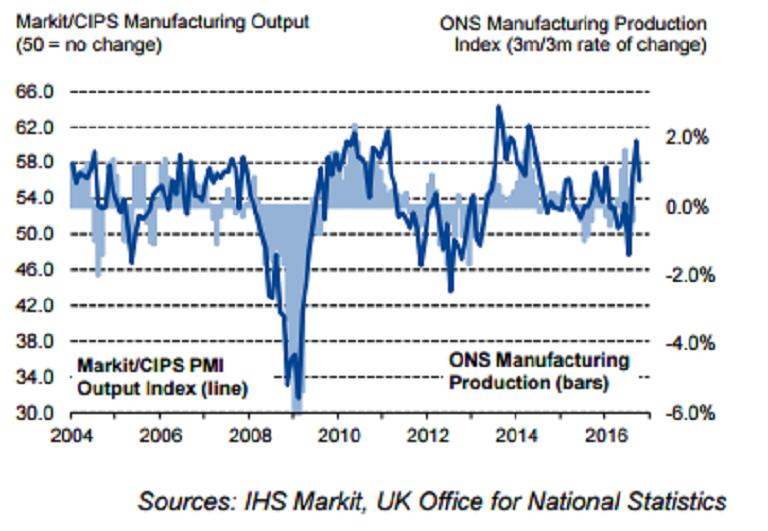

The UK Markit/CIPS UK manufacturing PMI index declined to 54.3 for October from a revised 55.5 the previous month, which was originally reported as 55.4. The data was slightly below consensus expectations of 54.6, but remained well above the long-term average of 51.5.

New order volumes increased for the third consecutive month and at a pace close to September’s recent high. Companies reported higher demand from both domestic and export clients. Although the slowdown in output growth was more noticeable in comparison, the rate of expansion in October nonetheless remained solid compared to series average.

The strongest performing sub-sector was intermediate goods, which saw production rise at the quickest pace in a year. Output also continued to increase sharply at consumer and investment goods producers, albeit at markedly slower rates than in September.

Manufacturing employment increased for the third straight month during October. The rate of jobs growth accelerated to a one-year high. Companies linked higher employment to rising production requirements. Job creation was strongest at SMEs, while only a marginal increase was signaled for large-sized firms.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns