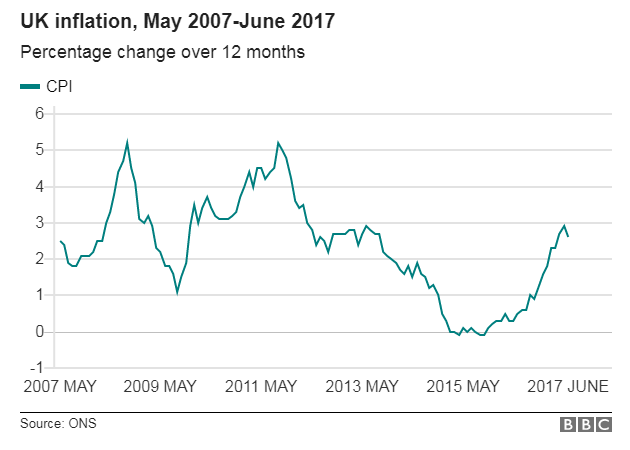

The UK's inflation rate unexpectedly slowed to 2.6 percent in June according to data released by the Office for National Statistics on Tuesday. Data widely missed expectations for a gain of 2.9 percent and compared to a 2.9 percent rise in the previous month. This is the first fall in the rate since April 2016 and was largely down to lower petrol and diesel prices.

On a monthly basis, the CPI came in flat missing a 0.2 percent estimated and compared to 0.3 percent in the previous month. While core inflation, which strips out volatile energy and food prices, was 2.4 percent, down from the 2.6 percent in May and also lower than the consensus.

The UK inflation rate has risen sharply since the European Union referendum last June, partly due to an increase in the cost of imported goods following the fall in the value of the pound. The inflation spike has put pressure on the Bank of England (BoE) to raise interest rates. But the latest figures will ease that pressure and analysts now see little likelihood of BoE rate hike next month.

"The Bank of England has taken a noticeably hawkish line recently, but today’s data casts doubt over a rate hike later this year," said James Smith, an economist at ING.

Last week’s wage growth data showed UK regular pay growing at just 2.0 percent for the three months to May. Inflation has been higher than average nominal wage growth in recent months, meaning fall in real pay. With wage growth still muted, the slowdown in inflation suggests that the decline in British real wages may have started to translate into a slower consumer inflation.

"While inflation dipping to 2.6 per cent in June offers some relief to consumers, it will still highly likely have been clearly above pay growth, thereby resulting in a further drop in consumers’ real earnings," said Howard Archer of IHS Global Insight.

The pound sterling slumped across the board after UK inflation data miss. GBP/USD was down 0.28 percent, while EUR/GBP was up 0.93 percent at around 1145 GMT. FxWirePro's Hourly GBP Spot Index was bearish at -121.55. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons