A Trump administration will present challenges to both Asian currencies and bonds. Trump’s pro-US growth and pro-fiscal stimulus economic policies coupled with a protectionist stance on global trade is a major setback particularly for trade-reliant countries like Singapore, Malaysia, Thailand, Taiwan and South Korea. Countries like Indonesia and India which are more domestically driven economies are likely to be less impacted.

Trump’s election proposals, which are pro-US growth supported by fiscal spending, will ultimately underpin the US economy, further boosting employment and wage growth. With U.S. labour market already close to full employment, it will push US inflation higher, meeting the US Federal Reserve’s dual mandate sooner than expected. Market pricing of a Fed rate hike at December meeting has risen to 80 percent after the elections and 36.8 percent of another 25bp hike by December 2017).

"We think there is a significant under-pricing of rate hikes beyond 2016. Our current house-view is for two 25bp hikes in 2017," said ANZ in a report to clients.

Asian region witnessed strong capital inflows of around USD39bn in the first nine months of the year on the back of the easy monetary policies of global central banks. The large portfolio flows into the region this year is at risk of a reversal as further monetary accommodation is now in doubt.

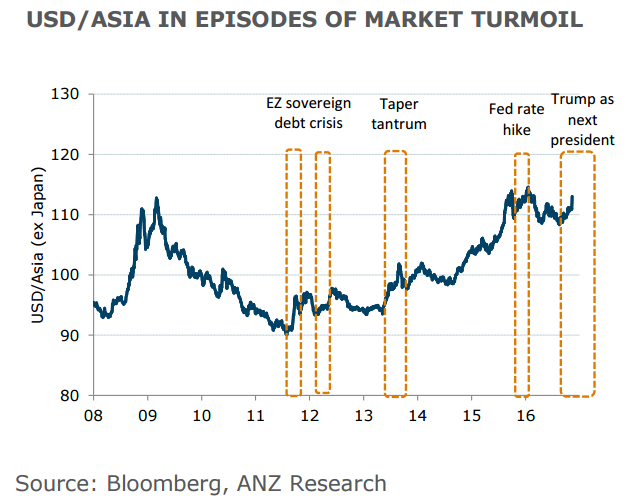

KRW and MYR are risk-sensitive currencies which are most vulnerable. RMB, together with the SGD is likely to lose further ground in trade-weighted terms. Asian bonds are also to come under pressure, extending the recent sell-off. Unlike in the previous episodes when Asian currencies rebounded swiftly after a short period of sell-off, the fall in Asian currencies this time round will most likely extend through 2017.

FxWirePro's Hourly Currency Strength Index was showing USD strength at +81.4924 at around 1245 GMT.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility