While its date and timing is not yet known, a referendum on British Exit or 'Brexit' from the EU is imminent. Opinion polls, conducted in wake of the Paris attacks of 13 November and the escalating Syrian migrant crisis, have started showing a rise in favor of a Brexit. One survey by pollster ORB showed 52% of British voters wanted to leave the EU while 48% wanted to stay; the first such study showing majority support in favor of an exit.

"Brexit odds are 20%, perhaps 30%. Benchmarking the FX impact of a vote to leave is little more than guesswork. We assume a 5% hit to the GBP index near term, extending to 10% if reserve managers sell and expose fragile current account fundamentals", says J.P. Morgan in a research note.

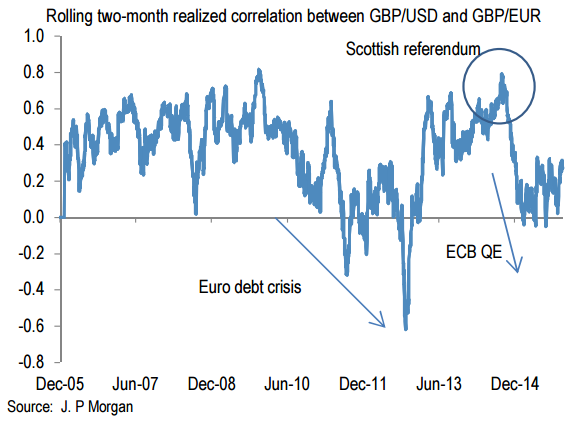

A Brexit will undoubtedly weigh on strength of the pound sterling. The economic consequences of Brexit are potentially profound, albeit highly uncertain, and the vote should command a risk premium in spot, more so in volumes and correlations. A Brexit risk premium is starting to be priced into options. This will intensify once a date is set. J.P. Morgan favours a 1Y bearish risk-reversal in cable.

UK general election result temporarily lifted political risk. GBP saw strong gains this year despite softer growth and BoE rate hike being delayed yet again. The backdrop to sterling in 2016 is not much different from that in 2015 so far as it combines no more than 2%, trend-like growth, a still tentative BoE, and dovish monetary policy in the Euro area and Japan. The major change is in the outlook for US monetary policy that should justify a temporal loosening in the perceived policy ties that bind GBP to USD, at least through Q1 and part of 2Q before the BoE itself moves on rates in May. However, BoE's sensitivity to FX pass-through should limit further gains even if the MPC does get going in May.

"The timing of the vote will determine the precise contours of GBP in 2016. Cable is expected to end 2016 at 1.57, EUR/GBP at 0.72 assuming a vote to remain and EUR/USD recovering to 1.13. Brexit would take cable to the low 1.40s, EUR/GBP to the mid 0.70s. A vote to remain accompanied with accelerated rate hikes would take cable to 1.62-1.63 and EUR/GBP to 0.66-0.67", notes J.P. Morgan.

The pound sterling hit highs of 1.5125 against the Greenback on the day, has pared some of the gains and is currently trading at 1.5089. Against the Euro, the sterling is seen consolidating near recent lows, was trading at 0.7022 as of 1115 GMT.

Timing Of Brexit Vote To Determine GBP Curve In 2016

Tuesday, December 1, 2015 11:35 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022