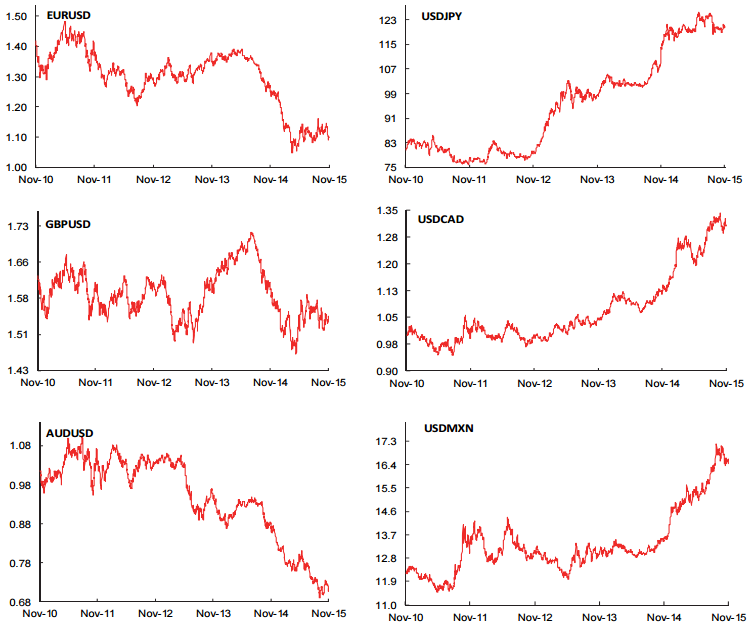

Economic, monetary, and political developments in the US (within the developed world) and in China (within the emerging-market world) will continue to drive market sentiment across asset classes. Tensions are de-escalated in global foreign exchange markets and range trading activity was seen after stabilization in commodity markets following swift adjustments in the first half of the year. Higher beta assets have performed well through October despite renewed focus on Fed tightening expectations.

Stellar non-farm payroll readings (last Friday) have strongly anchored Fed's December rate hike bets. Analysts are bullish on the outlook for the USD through 2016 on the grounds of persistently attractive growth and interest rate differentials. The Greenback has managed a second consecutive higher close versus its major peers on the month in October. Majority of USD gains were concentrated against the European currencies but more consistent USD strength suggests a stronger sense of conviction among investors about USD direction going forward.

USD/CAD is expected to edge higher in 2016. Daily price action in the pair has edged above the cloud. The pair is currently trading at 1.3274, with cloud top at 1.3268 the immediate support. Rejection of old double top at 1.2835 reflects bullish bias in USD/CAD and a close above 1.3280 is required to assert uptrend. Low energy prices and interest rate differentials will work against the Canadian dollar (CAD) as US interest rates rise. Scotiabbank estimates USD/CAD to peak around 1.39 in H2 2016.

With ECB President Draghi sending strong signals that additional monetary stimulus may be introduced in December in response to persistently low inflation, EUR/USD is expected to underperform broadly in the coming year against most major currencies. The revival of the euro zone/US policy divergence narrative could see a sharp downward adjustment in the exchange rate in the next few months. RBC Capital Markets sets 1-3 month targets for the pair at 1.0521 and further below at 1.0458.

Bank of England is expected to follow the Fed to begin its own policy normalization process early in 2016. The Pound Sterling is expected to remain better supported as a result but "Brexit" risks remain a threat to the constructive GBP view. Cable has been stuck between 1.5929 and 1.5107 since May 2015 (6 months). Recent rallies failed at key long-term resistance trendline at 1.5582. Bearish trend reversal in GBP/USD targets 1.5000 area initially and then 1.4994. Cable is currently trading at 1.5099, recovering from post FOMC falls to 1.5027 levels.

Despite slow growth and low inflation in Japan as well as rising US bond yields, the BoJ has failed to introduce additional stimulus measures at the late October policy meeting. USD/JPY has seen a bullish break out from its trading range since Aug. The path towards Fed tightening still represents a risk for developing markets; however, tighter USD liquidity implies heightened competition for funds and the risk that investors become a little more sensitive to the risk/ reward equation. USD/JPY is trading above 123.00 handle, bullish moves to continue. The pair is currently at 123.37 and is on track to test 123.50 - August 21 high.

Within the Americas, The Mexican peso (MXN) remains an attractive high yielding currency, given its alignment to the US business cycle and the structural premium provided by deep local-currency bond markets. The acute political and economic crisis in Brazil is prolonging the weakness of the Brazilian real (BRL) at a time when substantial fiscal and current account imbalances and rising debt levels anticipate fuel the likelihood of multiple credit rating revisions. USD/MXN was trading at 16.7992, while USD/BRL was at 3.7701 as of 1056 GMT.

Key ideas that will drive foreign exchange markets ahead

Monday, November 9, 2015 11:09 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings