Australia’s economic growth for the fourth quarter of this year is expected to stay below 4 percent, following concerns over downside risks to investments ahead of the February 2019 elections and slowdown in manufacturing due to weaker exports, according to the latest report from DBS Group Research.

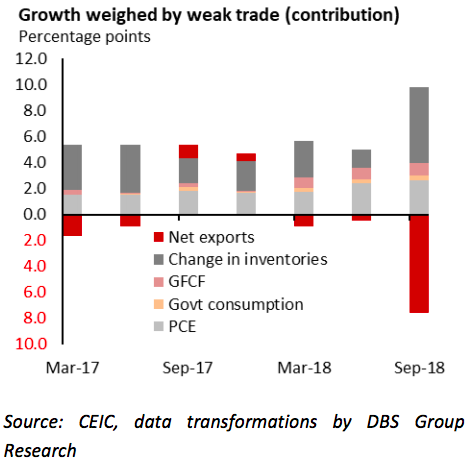

Thai growth slowed more than expected in Q3, undershooting consensus by a wide margin. Growth eased to 3.3 percent y/y, sharply lower than 4.8 percent in H1 2018. Growth plateaued on m/m terms, down from a revised 0.9 percent in Q2 and 2.0 percent in Q1.

Following the data release, the NESDB trimmed its forecast to 4.2 percent for 2018, more conservative than the Bank of Thailand (BoT) at 4.4 percent and Finance Ministry at 4.5 percent. The NESDB pegged 2019 growth at 3.5-4.5 percent.

At last week’s policy review, the central bank had signalled that a hike was near. Firm domestic sectors (consumption and investment) might still give them the confidence to tighten policy in December or early 2019 (to create buffers for future contingencies), but it will be a close call, the report added.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk