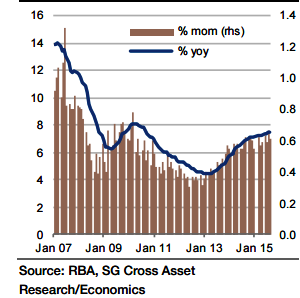

Australia's October Private Sector Credit came in at 0.7% on month on month basis, same as per the expectations by market consensus and modestly less than that of previous month's 0.8% mom.

The overall private sector credit growth for the month of September was higher than the consensus expectations of 0.5% and recorded highest for 7 years.

The affordability owing to solid appreciation in prices is falling. There is no reliability in the split between owner-occupiers and housing investors, due to re classifications, shifting te focus on total housing loans.

"The major banks' autonomous mortgage rate increase of 15-20bp in October is unlikely to have left any discernible mark on the latest data quite yet, but over the coming months some marginal impact should be expected", says Societe Generale in a research note.

Surge in loans to businesses drives Australian Private Sector Credit growth

Monday, November 30, 2015 5:29 AM UTC

Editor's Picks

- Market Data

Most Popular

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality