At its extraordinary monetary policy meeting on 6 April 2017, the Bank Board of the Czech National Bank (CNB) decided to discontinue the cap in the Czech crown. By taking this step, the CNB returned to the conventional monetary policy regime, in which interest rates are the main instrument. As the bank dropped its cap on the value of the crown, it has opened the door to a rise in interest rates.

According to the CNB's latest projection, the central bank should hike official rates in the third quarter of this year. However, analysts expect the first rate rise next year. CNB’s governor Rusnok has joined other Czech central bankers as he stressed that the central bank would postpone its hiking cycle if the koruna extends its gains.

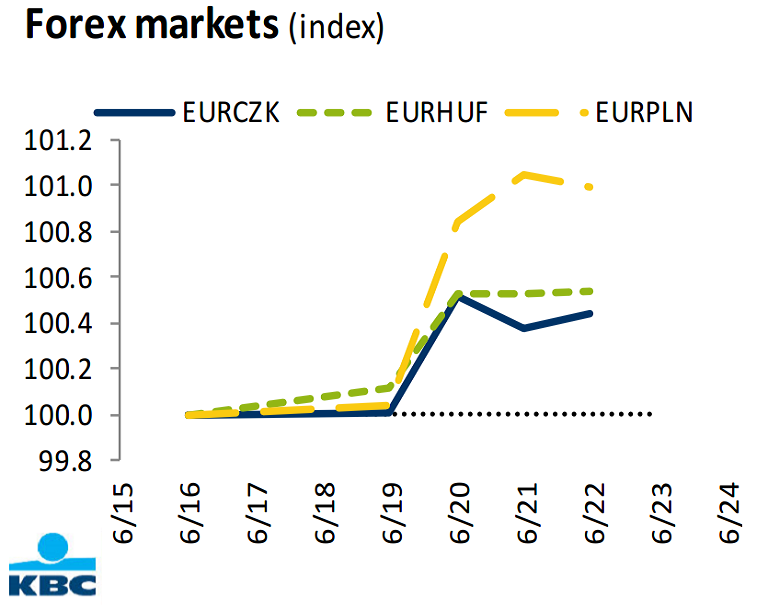

The long-term fundamentals behind the Czech koruna have improved significantly since the start of the interventions. The Czech crown hit its highest level since the central bank exited its cap on the currency in April, boosted by higher than expected May inflation data. EUR/CZK hit lows of 26.1127, levels unseen since November 2013. Higher exchange rate pushes inflation higher.

The Czech inflation figures for May have surprised on the upside as the headline figure reached 2.4 percent y/y. Inflation was above market forecasts but below the central bank's own prediction of 2.6 percent. The bank targets inflation at 2 percent. The CNB may put off raising interest rates to beyond the third quarter if the crown keeps strengthening at the pace seen in recent weeks. Focus would also be on the European Central Bank's asset-buying programme. A potential delay in the departure from quantitative easing would also affect Czech interest rate increases.

"If we raise rates, we may do it even under a situation when the ECB still is in an unconventional regime. We would do it very slowly and sensitively, in order to avoid capital inflows and the crown firming even more," said CNB bank board member Marek Mora.

EUR/CZK has edged higher from lows of 23.1127 and is currently trading at 26.2755. USD/CZK was trading at 23.5492 at around 1200 GMT. FxWirePro's Hourly EUR Spot Index was at 82.7411 (Bullish), while Hourly USD Spot Index was at 32.5217 (Neutral) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks