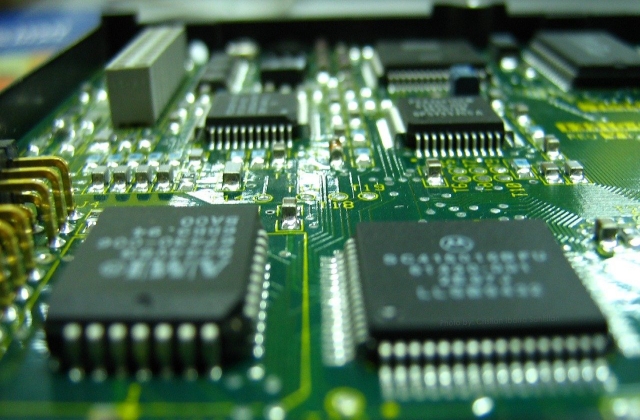

Sony Group Corp. and Taiwan Semiconductor Manufacturing Co. are cooperating to build a new chip plant in Japan. The Japanese multinational company headquartered in Tokyo is contributing to the project by agreeing to invest around $500 million.

Taiwan’s TSMC is currently building a semiconductor facility in the country and this move has been welcomed by the local government so it is getting a lot of support. As per Reuters, it was posted on the regulatory filing that Sony Group’s subsidiary, the Sony Semiconductor Solutions Corporation, is the one investing in TSMC’s chip plant and its contribution is said to be equivalent to less than 20% of the new project’s total value.

Sony Group and TSMC’s collaboration to construct a $7 billion chip factory is part of their efforts in helping ease the chip shortage and strained global supply chain for the valuable semiconductors.

“The digital transformation of more and more aspects of human lives is creating incredible opportunities for our customers, and they rely on our specialty processes that bridge digital life and real life,” TSMC’s chief executive officer, Dr. CC Wei, said in a press release that was posted by Sony on Nov. 9. “We are pleased to have the support of a leading player and our long-time customer, Sony, to supply the market with an all-new fab in Japan, and also are excited at the opportunity to bring more Japanese talent into TSMC’s global family.”

Sony Semiconductor Solutions Corporation’s president and CEO, Terushi Shimizu, also said that while the chip shortage may last longer than expected, they are hoping that the team up with Taiwan’s TSMC will greatly contribute to securing a stable supply of logic wafers not only for Sony but for the entire industry. He went on to say that its new partnership with the Taiwanese chipmaker is very meaningful to Sony Group.

Meanwhile, the construction of the chip factory is ongoing and the production of semiconductors may begin in the latter part of 2024. Thus, the companies may not be able to immediately help in addressing the chip shortage that is affecting the tech and auto industries.

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins

DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal