The week was dominated by Federal Reserve communications. Remarks by several regional presidents helped cement market expectations for a December hike, with the odds remaining near 70%. Alongside slumping commodity prices, the looming reality of a December liftoff weighed on equity markets.

The N.Y. Fed President Dudley reiterated the Fed's prevailing bias to raise rates this year, noting that "the conditions ... to begin to normalize monetary policy could soon be satisfied." Presidents Lacker and Bullard were also supportive of a near-term liftoff. Alongside slumping commodity prices, the looming reality of a December liftoff weighed on equity markets, which ended the week in the red. While somewhat dated, the September JOLTS report surprised to the upside, as both new job vacancies and unfilled vacancies rose on the month. Initial jobless claims remained steady near the lowest level in over a decade, and alongside plentiful openings and above-trend employment gains suggest continued healing in the labor market.

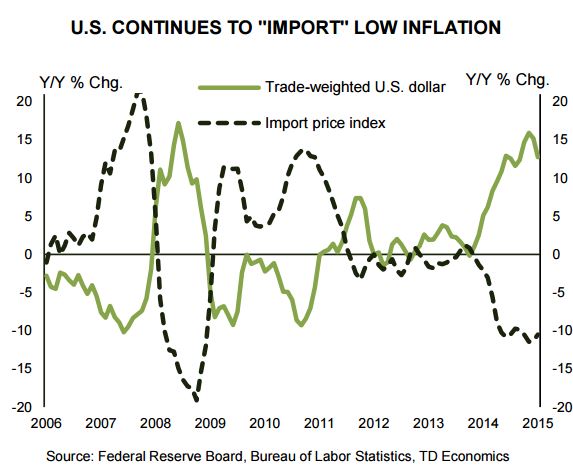

Falling oil prices and strengthening dollar continue to hold back inflation. The import price index was down 10.5% in October relative to a year ago. Signs of falling commodity and import prices could also be found in retail sales, which edged up by a modest 0.1% m/m, disappointing expectations. However, since retail sales are reported in current dollar (nominal) terms, the weakness in the headline could be overstating the slowdown in the real pace of consumer spending. Case in point being that while auto sales fell in nominal terms, actual units of autos sold are near record highs. Moreover, the retail sales measure is highly skewed toward goods. Services spending accounts for only 12% of the retail sales measure, but 68% of consumer spending more broadly.

Despite the disinflationary pressures, the forward-looking Fed is unlikely to wait to see "the whites of inflation's eyes" before raising interest rates. That being said, soft inflation and remaining slack in the labor market argue for a "gradual pace" of tightening. This view was also reiterated by President Dudley, who said that he didn't favor waiting to see "the whites of inflation's eyes" before raising interest rates.