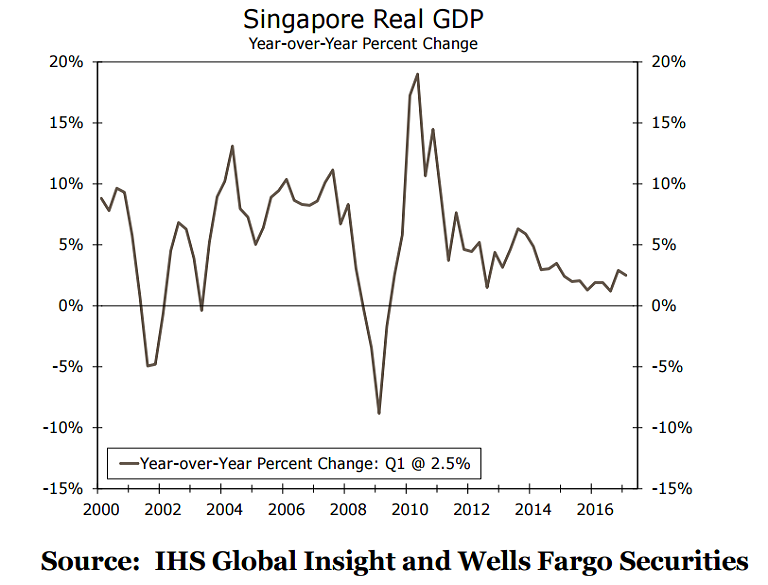

Singapore's economy lost some of its momentum in Q1 2017 as it contracted an annualized 1.9 percent from the previous three months, preliminary data from the government showed earlier this week. On a year-over-year basis, the real gross domestic product (GDP) in Singapore rose 2.5 percent in Q1-2017, largely in line with consensus expectations.

GDP figures are often volatile in Singapore and a breakdown of the Q1 real GDP data showed manufacturing activity contracted 6.6 percent in Q1 following a very strong Q4 in which manufacturing grew 39.8 percent. Construction output grew 5.8 percent in Q1, but is down 1.1 percent year-on-year. The services-producing sector, on the other hand, contracted 2.2 percent on the quarter but is up 1.5 percent year-on-year.

Growth in Singapore remains well below the supercharged growth rates experienced before the Great Recession. The slowdown in global trade has weighed upon the trade-reliant Singapore's economy which derives 60 percent of its income from final sales to foreign households, businesses and governments. Growth in global trade has been weak over the past few years and a return to the robust growth rates registered during the past two decades do not look likely anytime soon.

The nation's population dynamics also present a long-term headwind going forward. Working age population in Singapore is forecasted to peak in the next few years and then begin to decline. Hence, the productive capacity of the economy will not grow as fast as it has over the past few decades. Indeed, the International Monetary Fund forecasts that real GDP growth in Singapore will average 2.5 percent per annum between 2017 and 2021.

The CPI inflation rate in Singapore at present is less than 1 percent and sluggish economic growth is likely to keep inflationary pressures benign for a foreseeable future. Singapore’s central bank left monetary policy unchanged after the economy contracted in the first quarter, saying the neutral stance is appropriate for an extended period of time.

"We do not explicitly forecast the policy actions of the monetary authorities in Singapore, but the MAS probably will not sanction exchange rate appreciation anytime soon if, as seems likely, real GDP growth remains lackluster and inflation stays low. Indeed, our currency strategy team looks for the U.S. dollar to trend slowly higher versus its Singaporean counterpart in coming quarters," said Wells Fargo Economics in a report.

USD/SGD has been extending downside after hitting multi-year peaks of 1.45461 in January 2017, levels unseen since Aug 2009. The pair was trading at 1.3973 at around 0940 GMT. Major resistance was seen at 50-DMA at 1.4074 while 200-DMA at 1.3936 is major support on the downside. FxWirePro's Hourly USD Spot Index was at -101.118 (Bearish) at 0940 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals