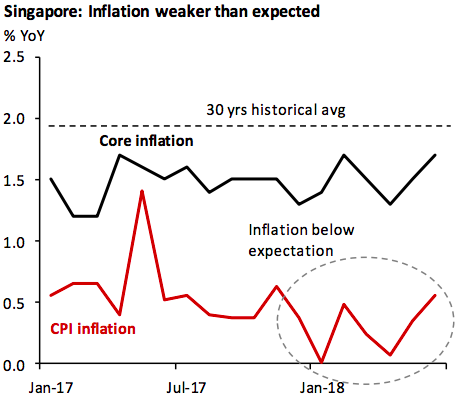

Singapore’s consumer price inflation forecast for this year has been lowered to 0.7 percent, from previous estimates of 1.0 percent, according to the latest research report from DBS Economics & Strategy.

While recent pick-up in inflation readings have been in line with DBS’ long-held view, average inflation for the first half of this year (0.3 percent y/y) has been lower than previously anticipated. There are signs that the subsequent increases in the coming months could be gradual.

The persistent decline has been largely driven by weak rentals on an existing supply glut and a moderation in the inflow of foreigners. While the decline shows some tentative signs of easing, the government’s recent and new property market cooling measures will weigh down on the property market and subsequently, on rental and accommodation CPI inflation as well.

"We continue to expect the core inflation series to remain range-bound between 1.5-2 percent for the rest of the year. On this account, there is little impetus for the Monetary Authority of Singapore (MAS) to shift away from its current gradual appreciation stance, particularly given the risk to growth arising from the external headwinds. We are also keeping to our inflation forecast of 1.8 percent in 2019," the report commented.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy