Singapore’s Export growth is likely to remain healthy, albeit slower. Headline non-oil domestic export figures for September due tomorrow is expected to register an increase of 12.3 percent y/y. This will be a moderation from 17.0 percent in the previous month but in line with our view that momentum should be gradually tapering-off towards the year-end, DBS Group Research reported.

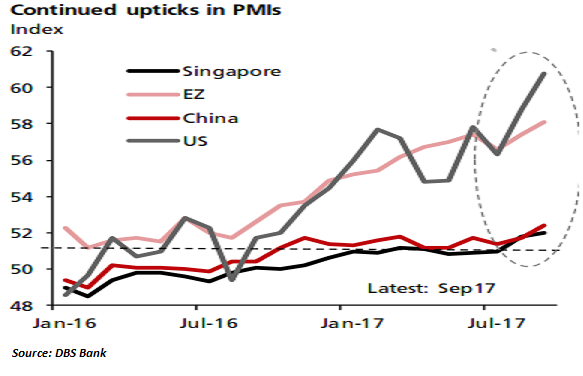

Nonetheless, this is still considered a robust expansion and continued to underscore the exuberance on the external front. The PMIs of key export markets have been strong while the rally in the electronics cluster is not abating. Hence, any sign of moderation should be seen as a shift towards a more sustainable growth path.

Going forward, China’s growth could moderate amid the process of deleveraging. Rising trade protectionism and monetary policy normalization by the US Fed and the ECB may also keep global demand in check. The Fed will likely resume its hiking cycle from December onwards while reducing its balance sheet. The ECB will likely follow suit in 2018. All these make for a softer global outlook, and henceforth, a drag on export performance in the coming months.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market