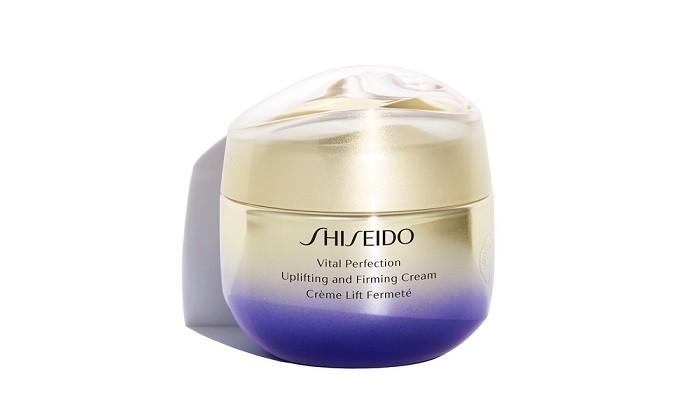

Shiseido Co. agreed will sell its shampoo and affordable skin-care business to CVC Capital Partners for $1.5 billion, as it shifts more focus to making and selling high-end skin products.

Under the deal, Shiseido will transfer its personal-care business to a holding company where CVC is an investor. Shiseido will then acquire a 35 percent stake in the holding company that will operate the business. CVC will oversee the new company, which may go public in the future.

The transfer price of the business and assets are valued at 160 billion yen with a transfer date set for July 2021.

The Japanese beauty giant has been revamping its portfolio with the pandemic changing cosmetic and personal care routines.

Among the businesses to be divested are its drugstore brands, including Tsubaki hair-care products and Senka face wash.

Shiseido has been contemplating about the future of its personal care business as it had not been able to give it the marketing and research and development resources it needed to grow.

The lifestyle and personal care business represented about 10 percent of Shiseido’s revenue in 2019, with annual sales of about 100 billion yen.

According to Shiseido CEO Masahiko Uotani, CVC and other groups have approached them about acquiring the segment. But he thought at that time that it was too premature to even when they began feeling the impact of the coronavirus pandemic.

Uotani noted that the personal care business model is very different from its focus as a beauty company.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO

Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins

DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices