As within all financial industries, the movement of money from one location to another has always been the riskiest part of daily business. In fact, the very concept of the police began in London as a private security force to protect the valuable goods and sometimes money from ships returning from overseas to the warehouses and headquarters of the respective companies. The Thames River Police, established more than 200 years ago, still exists in a more or less recognizable form as a branch of London’s Metropolitan Police.

Going back even further in history there is a clear philosophical framework for public protection of private property going back the late 1600s. Over the years industries developed their own methods of protection and eventually came to rely on public protection. Whenever a new territory opened up—be it a literal territory like the American West or a more abstract one like aviation—the early days are often fraught with danger owing to lack of protection and regulation. The most recent example of this has been computers and then the internet.

In the early days of the internet, there was much risk. With governments across the world slow to react, private online cybersecurity has become a strength-to-strength industry and is being employed both privately and publicly.

The online gambling industry, as an industry involved in the transfer of money, has always had an especially keen focus on security. Recommended online casinos in Canada have prioritized security, focusing not just on money security, but also the security of the integrity of the games themselves.

In fact, in many ways, security is a cornerstone of this industry so much that any in-depth online casino responsible gambling guide will focus on informing potential punters about rogue casinos with unreliable payment methods in addition to usual information about responsible gambling, age limits and so on.

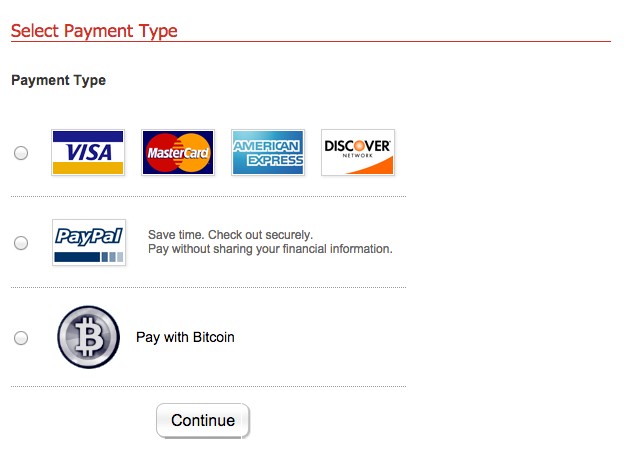

One of the recent trends in security of money is placing security in the money itself. This can be seen most readily when the advent of cryptocurrencies and their increasing usage in online transactions. Bitcoin, for example, uses SHA-2, a set of cryptographic hash functions that allow for integrity to be verified.

These hash functions work in a way that any input value will never create the same hash output as any other input value. Or to put it more simply, each input value has a unique hash output. This collision resistance, as it is called, means that it’s even possible to detect if any files, or in this case Bitcoins, have been tampered with. Bitcoin security over the last years has been much discussed and has consistently been at the forefront of cryptocurrency security, which is partly responsible for its success.

The possibility of a valuable possession that can secure itself is the holy grail of security. For some 400 years at least, the Western political philosophical canon has considered the government’s role as protector of the private citizen’s possessions. There has always been a historical example of the codependency of valuables and security, whether it was armed guards and a shipment of gold or a patented idea and intellectual property law. With the possibility now of a currency that can protect its own integrity, the future of online security proves to be an industry to watch.

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks